Update

EEBA is now Goodbudget! Goodbudget has all the great features of EEBA (and more!) in a new and updated interface. Check out the Goodbudget Help Center for the most recent help content.

Q: What is the “sweep” Envelope? How can I use it?

The “sweep” Envelope is like your own personal penny jar. When you record an income with the “Specify” option, EEBA will ask how much money was received and how you’d like to fund your Envelopes. Often, the amount of money you receive will be different from how much it will take to fund your Envelopes. This means that EEBA will have a little extra –or be left a little short– when funding your Envelopes. This leftover bit is sent –or taken if you’re short– to the “sweep” Envelope.

(Note, if you’re wondering how to fund your Envelopes with “Specify” without using a sweep, click here.)

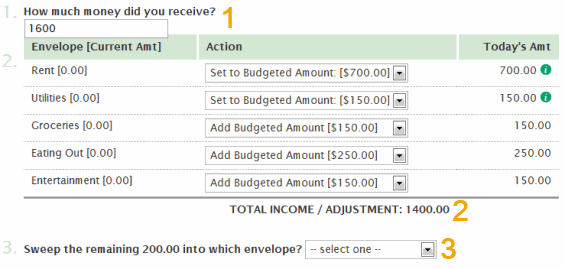

For example, here we see a user recording their income of 1600.

However, funding this user’s Envelopes will only take 1400. This leaves them with a remainder of 200 (1600 – 1400 = 200) What does EEBA do with that 200? It sends it to the “sweep” Envelope.

Which Envelope should I pick as my “sweep” Envelope?

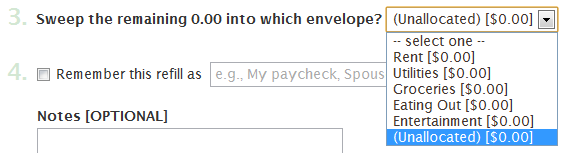

When selecting your sweep Envelope, you can choose any of your Envelopes in EEBA or your Unallocated Money. Which Envelope you choose depends on what you want to do.

- Savings: If you have a long-term Savings Envelope, that would likely be the best option for your sweep, letting you grow your savings over time.

- Unallocated Money: If you’re living paycheck to paycheck, sweeping a surplus to Unallocated Money will help you build a cushion for your budget.

- Debt Reduction / Payoff: If you’re paying down existing debt you could sweep the remainder to a “Debt Reduction” or “Debt Payoff” Envelope.

- Giving: Alternatively, if your regular expenses are covered you could always budget the surplus towards giving.

The choice is up to you. Be generous, and be creative!

What if my sweep is negative?

Life happens, and sometimes our budgets take a hit. If you happened to overspend last month or received less income this month, you may be asked to sweep a negative amount. This will remove funds from the sweep Envelope. When this happens, you have a few options:

- Distribute Less to Your Envelopes: Look over how you’re adding money to your Envelopes and see where you can cut back. Bringing your negative sweep back to “0” will mean you’re only distributing money you actually have, and that’s good!

- Pull Money From Unallocated or Another Envelope: If you have spare money elsewhere, say from your Unallocated Money or a rainy-day Envelope, you may want to pull the money you need from there.

If this is a one-time occurrence you’re probably safe, but if this happens repeatedly you’ll need to make a change. It may be time to take another look at your budget and find ways to either earn more or spend less.

I just want to reset my Envelopes in different ways each month!

How can I do that without using sweep?

If you just want to keep track of your spending –and don’t need to keep track of your income– you can do the following:

- Choose “Specify” and fund your Envelopes as you normally would.

- When you’re done, look at the “Total Income / Adjustment” number near the bottom of the page.

- Enter that as your income under “How much money did you receive?”

That’s it. That will let you fund your Envelopes the way you want each month without having a remainder to put away somewhere.

Thanks to S.D. and T.R. for the question!

14 thoughts on “FAQ: How to use the “Sweep” Envelope to Build Savings or Pay Down Debt”

Looks like sweeping to unallocated is new, and so is being able to allocate without having to pick a sweep? (I remember even if I had 0.00 I still had to pick a sweep account).

Hi Shannon,

Yes, we added Unallocated as a sweep option a little while ago, around the time we rolled out Unallocated Money as a feature for all our users. I’ve found it’s really useful if you’re not sure what you want to do with the money yet. Do I want to commit it to Savings? Pad my Eating Out Envelope? Sweeping to Unallocated lets me track the surplus without having to make a decision on what to do with it right away. For certain kinds of people –like me– that’s really handy.

You normally shouldn’t have to pick a sweep if the remainder is “0.00” but there’s an internal rounding bug that sometimes causes the system to think there’s a remainder when there really isn’t. It’s rare, and it won’t ever affect your actual Envelope balances, but sometimes, yes, EEBA will ask you to pick a sweep even if the remainder is “0.00.”

How do I zero out my unallocated money?

(During my initial setup, I ended up with an erroneous amount as “unallocated”: It’s not really there to distribute.)

Hi Christopher,

Generally, I’d recommend you contact support for specific questions but let me answer your question here for convenience.

If you have an amount of Unallocated Money that is a mistake, the best option would be to find the offending transaction that caused this mistake and correct it. That may be a funding transaction, or the creation of an Account if you’re on our Plus or Premium plans.

Alternatively, if you have a positive amount of Unallocated Money that you’d like to zero out, you can distribute it to an Envelope and then record a transaction against the Envelope. If you have a negative amount of Unallocated Money, you can zero it out by recording an income and choosing Keep Unallocated.

Hope that helps!

I didn’t spend all budgeted money in envelopes, but I want to move the about to savings before I fill my envelopes to the specified amounts. How do I do this? Will the area I overspent balance out before the amount goes to savings?

Hi Ed–If you’d like to move all of the leftover money into Savings, you can head to the Goodbudget webpage and click on the “Fill Envelopes” button. Click the “Set” button for each monthly Envelope you’d like to set to 0 and it will remove any extra money, or add money if you went over, from your Envelopes so that they become 0.

Then, over in the “Fill Summary” box, the amount called “Allocated This Fill” will show you how much you have left after you’ve balanced your monthly Envelopes to 0. If you have leftover money, it will be a negative number (if it actually took more money to pay the Envelopes you overspent in, it will be a positive number).

Just enter this amount into the Savings Envelope textbox as a positive number and click “Fill ‘Em!” to save. Then you’ll be ready to fill your Envelopes for the new budgeting period!

Hi,

I have a savings envelope that i use to sweep the leftover money at the end of every month. However, this envelope shows as “Spending” in the reports. Is there a way to exclude it so that reports only show the actual spending?

Hi Sotiris – Are you adding expense transactions to your Savings Envelope? If so, to clarify, all Envelopes that have expense transactions will show up in your spending reports. What you can try is transferring funds from your Savings Envelope to your other spending Envelopes and then spending out of that new Envelope. That way, your Savings Envelope won’t show up in your reports. Feel free to shoot me an email at support@goodbudget.com if you have more questions.

I would please like a step by step guide to just tracking spend from envelopes, and resetting the envelope amounts at the end of every month. The above does not help at all.

Hi Jacques – You can see a tutorial on how to track expenses here: (http://help.goodbudget.com/customer/en/portal/articles/1043762-step-5-record-your-expenses). And, here’s a tutorial on resetting your Envelopes: (http://help.goodbudget.com/customer/en/portal/articles/1043754-step-4-fill-your-envelopes)

Is it possible to change from monthly to weekly? Our paychecks in New Zealand are weekly

Hi John – You can create a weekly budget by changing your Primary Budget Period to Weekly. When you do that, you’ll also be able to add income and fill your Envelopes on a weekly basis. You can see how to change to a Weekly Budget Period here. Hope that helps!

I’m getting money sweep into my unallocated monthly but the numbers just aren’t adding up.

There shouldn’t be any money left over to sweep.

As my income to budgeting is $0

Hi Jessica — sorry for the troubles and confusion here. If you’re still having issues with this, can you send us some screenshots at support@goodbudget.com so we can take a closer look at what you’re seeing and try to help you out? Thanks!