Explained to you through Jelly Beans

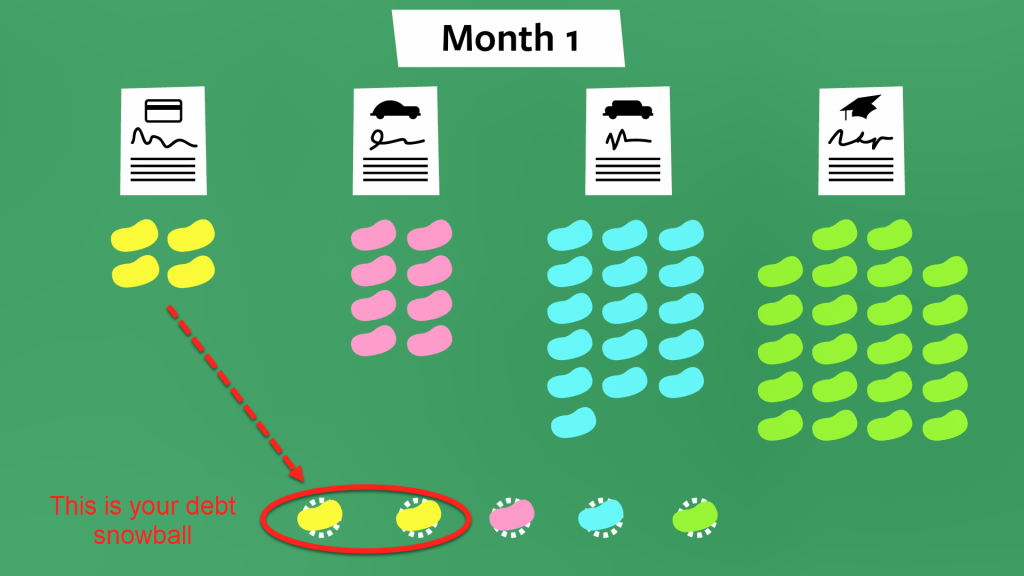

You start by putting all your extra money towards paying off your smallest debt first while still paying the minimums on all your other debts.

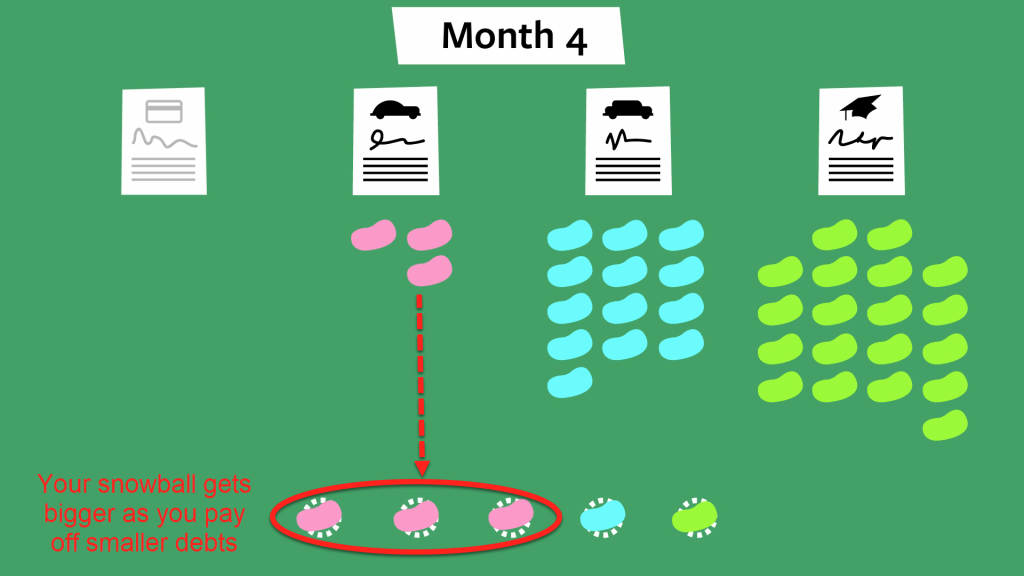

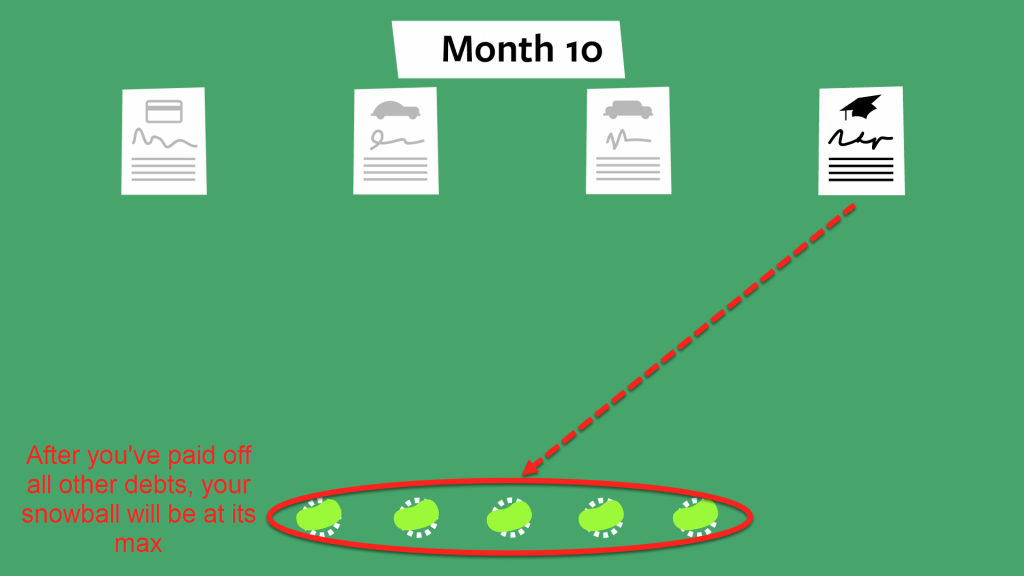

Once your smallest debt is paid off, you’ll throw everything you can toward paying off your next smallest loan, while still paying the minimums on everything else. You’re not paying on the first debt any more, so you’ve got more money to roll into a snowball to throw at your new target. And your snowball will get bigger as you pay off each debt!

Keep working on paying off your next smallest debt until you’ve paid them all off. And when you’re done, remember to celebrate!

Debt Avalanche is a repayment plan that helps you save money overall by paying down the debt with the highest interest rate first. Once that’s paid off, you’ll put all of your extra money toward paying off the debt with the second largest interest rate, and you’ll continue doing that until you’re debt free.

Use Goodbudget to track your debt payoff progress. Whether you use the debt snowball or another method, you can use Debt Accounts on the web to track your payoff progress and create budget that works with the repayment plan you choose.

Ready to tackle your debt for good? Learn how to crush your debt using the time-tested Debt Snowball method with Goodbudget 123: Be Debt Free.

Budget well. Live life. Do good.

© 2009–present Dayspring Partners | Terms | Privacy | Press Resources

Android, Google Play, and the Google Play logo are trademarks of Google LLC. | Apple, Apple logo, iPad, iPhone, iPod touch, iTunes, and Podcast Logo are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc. | EEBA, the Easy Envelope Budget Aid, the EEBA mascot, “You can keep a budget, EEBA can help,” Goodbudget, the Goodbudget mascot, the Goodbudget envelope, and “Budget well. Live life. Do good.” are trademarks of Dayspring Technologies, Inc. SPC, a San Francisco custom web app development company.