Take the fear out of budgeting with our step-by-step guide to crafting a budget you can really live with.

Step 1. Relax!

Before you do anything, take a deep breath and relax… feel better? We’re not here to make the perfect budget, or change your financial world overnight. We’ll get to that later. For now we just need to put together a budget that we can work with. There will be plenty of time to reflect and make changes later. The most important thing is to just get started, and keep going.

Step 2. Choose How You Want to Budget

It’s best to start your budget with the information you already know. Most often this is either your past spending habits or your current income. Both are great ways to start a budget so don’t fret over which one to pick, just go with whichever sounds easier in your current situation.

Option A. Budget Off Your Past Spending

To create a budget based on your past spending, you’ll look at how much you’ve been spending in the past and use those patterns to guide your future spending. How you’ve spent in the past might not be exactly how you’d like to spend in the future — especially if you want to spend less than your income — but knowing those numbers is a good starting point.

Start by finding records of your past spending and organizing that spending into categories that make sense to you, like groceries, household expenses, fun, etc. You can find your past spending history by looking through your financial records, such as credit card or bank statements.

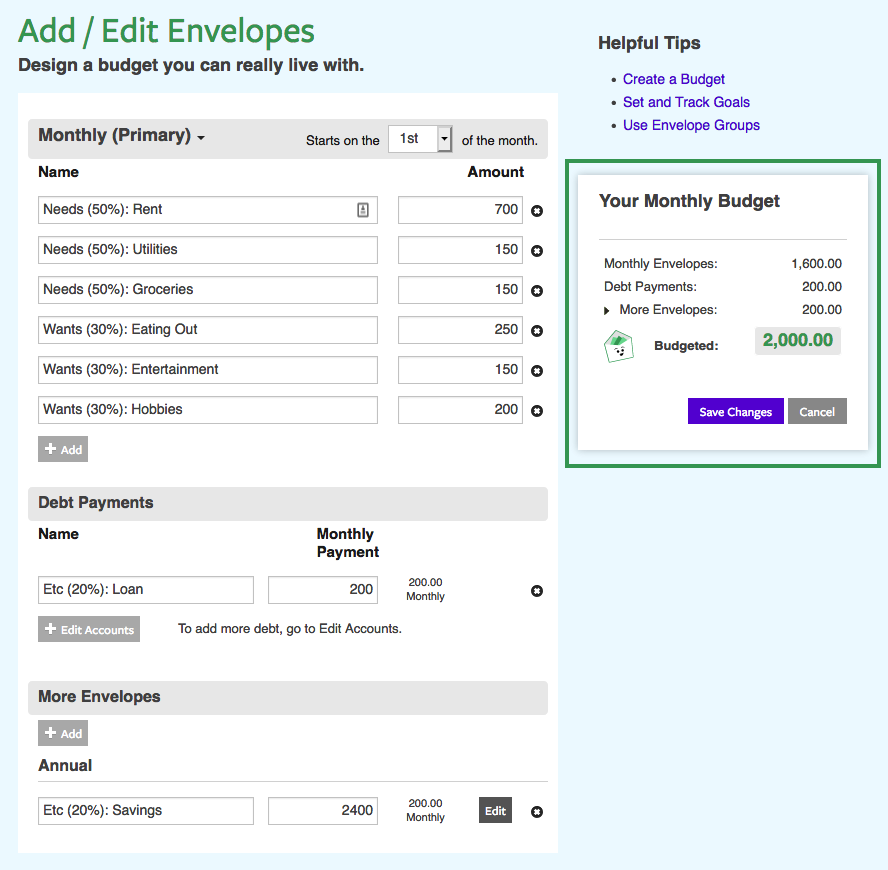

Once you’ve organized your spending, use that information to create your Envelopes with budgets in Goodbudget. Click on the “Add/Edit” button in the main Envelope tab to head to the Edit Envelopes page.

Don’t worry about the exact numbers for now — these are just guesstimates. If your records show that you spent $150 on “Groceries” last month, create a “Groceries” Envelope and give it a budget of $150. You’ll have time to reflect on these numbers later, and the great news is that you can always come back and change them if you find they don’t work.

After you’ve created all the Envelopes you plan to track, keep an eye on the ‘Budgeted’ figure in Step 3. The goal is always to make sure that you’re budgeting (and therefore spending) less than you earn. If you’re not sure how much you bring in each month, head back to your account online and tally up one month’s worth of regular income to see what the number is.

When you’re done, move on to Step 3 below.

Pro tip: Instead of vaguely trying to build up savings just because, decide on something specific to save for, like holiday gifts. Then make an Envelope called “Holiday Gifts” and give it a realistic amount. That way, even if you get off track somewhere else, you’ll be less likely to say, “Oh, I guess I’ll just use savings” since you’ll want to protect the money you’ve saved in your Holiday Gifts Envelope.

Option B. Create a Budget Based on Your Income

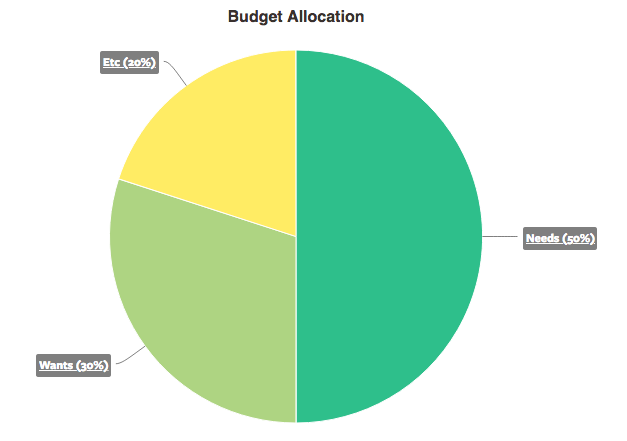

As the name suggests, a budget based on your income proactively assigns a role for each dollar you make. It’s a great way to manage your money, and it’s also the best way to make sure you’re not spending more than you make! A good rule of thumb is to use a 50-30-20 breakdown for your budget. Start with your after-tax income – the amount that goes into your bank account each paycheck – and break it down into three parts:

50% Needs: Expenses you have to pay, like rent, utilities, and groceries.

30% Wants: Expenses you choose to pay, like eating out, and entertainment.

20% Savings / Debt Reduction: Money you save, or use to pay down debt.

So, if you take home $2,000 a month, set a budget that allocates $1,000 to your needs, $600 to your wants, and $400 to your savings or debt reduction. But keep in mind that these are just guidelines. If your situation requires you to spend more than 50% on your needs, then of course you should do so.

When you’re ready, create your budget in Goodbudget. What Envelopes make up each of these categories will vary depending on your personal circumstances, but if it helps, feel free to use the Envelopes mentioned above as a starting point.

Step 3. Evaluate

Now it’s time to step back and take a broader view of your budget. Think about the whole year instead of just one month. What do you spend on once or twice a year (like Christmas Gifts and Car Insurance)? Make Annual or Goal Envelopes for those expenses.

If you used Option A and based your budget off your past spending, take a moment to reflect on your spending and decide if there are any changes you’d like to make. Maybe you’d like to spend less on eating out, or more on that hobby you wanted to get into. Use your budget to help you make those decisions.

If you used Option B and based your budget off a percentage of your income, give the hard numbers you ended up with another look to see if they make sense. You may need to spend more than 50% of your income on your needs, or maybe you can’t afford to spend 20% on savings at the moment. Don’t worry about it, but keep your general goals in mind as you adjust your budget to fit your life.

Also, if you haven’t already, consider making room for giving or generosity in your budget. Being generous with a portion of your money can often take the stress and worry out of managing the rest of it. As a final check, make sure you’ve planned to spend less than you earn. If not, adjust some of your Envelopes to make your budget fit within your income.

Step 4. Give It A Try!

Congratulations! You just finished setting a budget. You might not be sure about some of the numbers you see in your budget right now, don’t worry about it! You can always change your budget later. Now it’s time to put the number crunching away and just starting using your budget.

Fund your Envelopes!

Enter your expenses!

Enjoy real-time sync between your mobile devices!