How to Budget with Kakeibo

Kakeibo for the 21st Century

What is Kakeibo?

If you’ve been watching your morning talk shows, then you’ve probably heard of kakeibo. Kakeibo literally means “household finance ledger” and hails from Japan. While it’s not a new budget method, it’s only recently started gaining traction here in the States. So, we thought we’d take a moment and explain how it works.

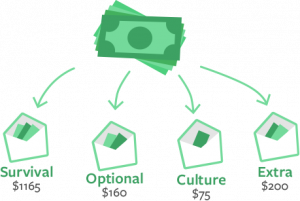

At the start of the month, you sit down write out all of your income and fixed expenses. Once that’s done, you know what’s left for spending and what’s left for saving. The savings are immediately set aside, and all expenses that fall into one of the four predetermined tracking categories are written down as the month goes on and purchases made. Those categories are:

- Survival: food, rent, transport, kids

- Optional: eating out, shopping

- Culture: books, music, shows, movies, magazines

- Extra: irregular events such as gifts, repairs, furniture

You can think of those categories as Envelopes in Goodbudget. So, you have a full money bag that you can then disperse to your Envelopes.

At the end of the month you’ll be able to see how well you stayed on budget and can tallying up your spending to see if you went over or under. That determines how much you’ve actually saved for that month. Then, the process starts over for the new month.

Here’s where Goodbudget comes in

In Japan a recommended budget tactic is to take cash out for the week or month and stuff it into a literal paper envelopes. So the kakeibo method lends itself well to envelope budgeting. And, because kakeibo requires you to sit down and write out all of your spending in a physical ledger, you’re more aware of your spending, which is awesome!

With the Goodbudget website and mobile app, you can take all of the principles of kakeibo and make it digital and on your phone.

You’ll start by entering income, and creating a budget that works for you. Create Envelopes with categories you’d like to monitor, like Survival and Culture. Track where your money goes by manually adding transactions as they happen or by syncing with your bank, and know how much you have left to spend before you spend it. You’ll be more aware of your spending, and can make informed spending decisions when you need it most.

What are you waiting for?