Budgeting is essential nowadays. If you don’t have a budget, it’s difficult to make sure you’re staying within the limits of your income or to know whether or not you’re accomplishing your financial goals.

If you’re considering a budget worksheet as a means to create a budget you can stick with, you’ve come to the right place.

Here are some steps to help you create a simple budget worksheet.

Step 1: Create your budget worksheet document

We’ll be using our budget software, Goodbudget, to demonstrate the next steps, but you’ll start by choosing the spreadsheet program you want to use. If you prefer Excel, use that. If you like the cloud syncing abilities of Google Sheets, use that.

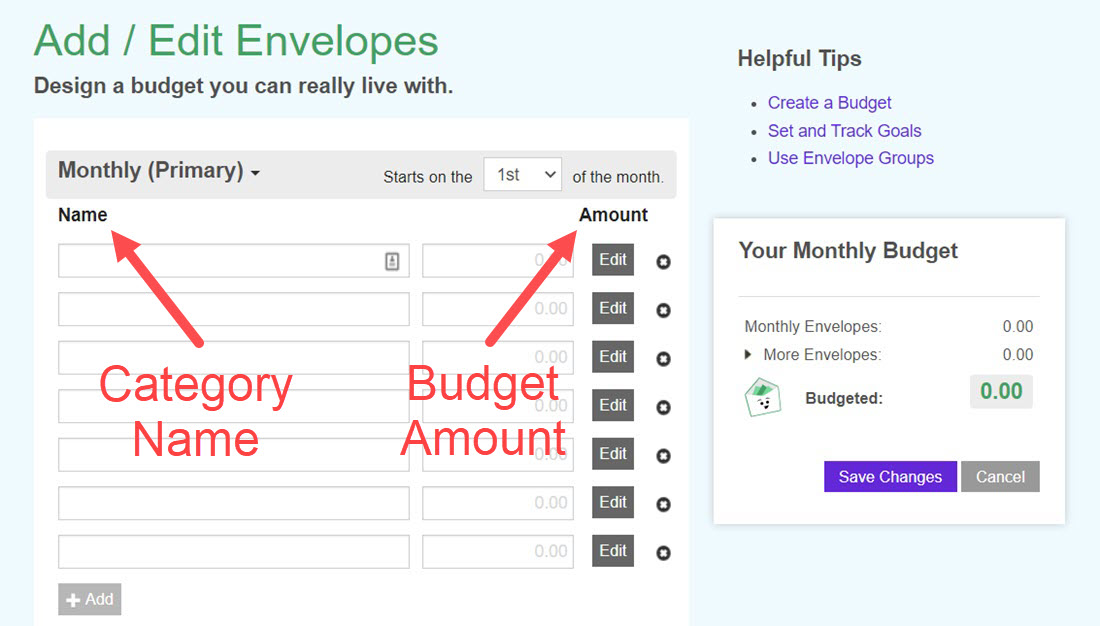

Once you’ve made your document, create some columns. At the minimum, you’ll need a Category, Budget and Income column, but you can track other metrics you think will be helpful for you.

Step 2: Use past spending to name the Categories in your budget worksheet

In this step, you’ll use your past spending habits to help determine the Category names you should track in your budget worksheet.

Start by logging into your online bank account and filtering the results to see your spending from the most recent full month.

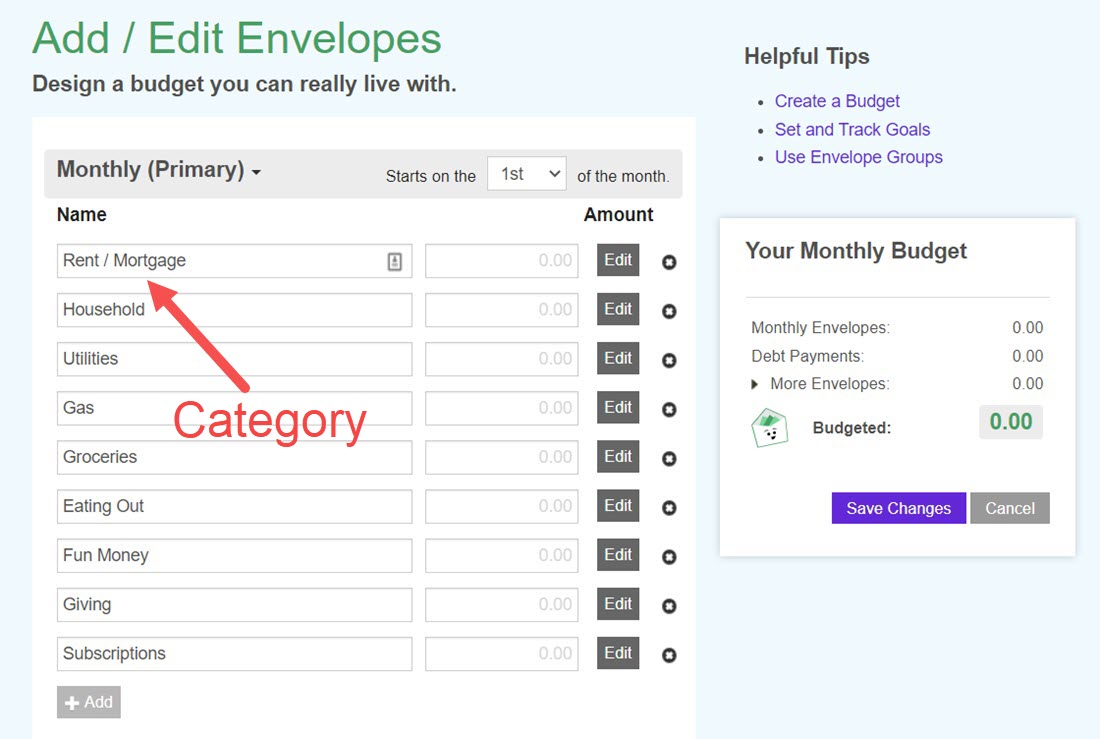

Next, start creating categories based on patterns or trends you see. For example, if you see frequent purchases at restaurants, add Eating Out to a cell under the Category column in your worksheet. You’ll probably also need categories for things like Bills, Groceries, Rent or Mortgage. And don’t worry if you miss a category. You can always come back and add more as they come up.

Once you’ve categorized all of the transactions, move on to the next step.

Step 3: Tally up your spending to determine your budget

Now that you’ve sorted your spending into categories, the next step is to figure out how much you should budget for each one.

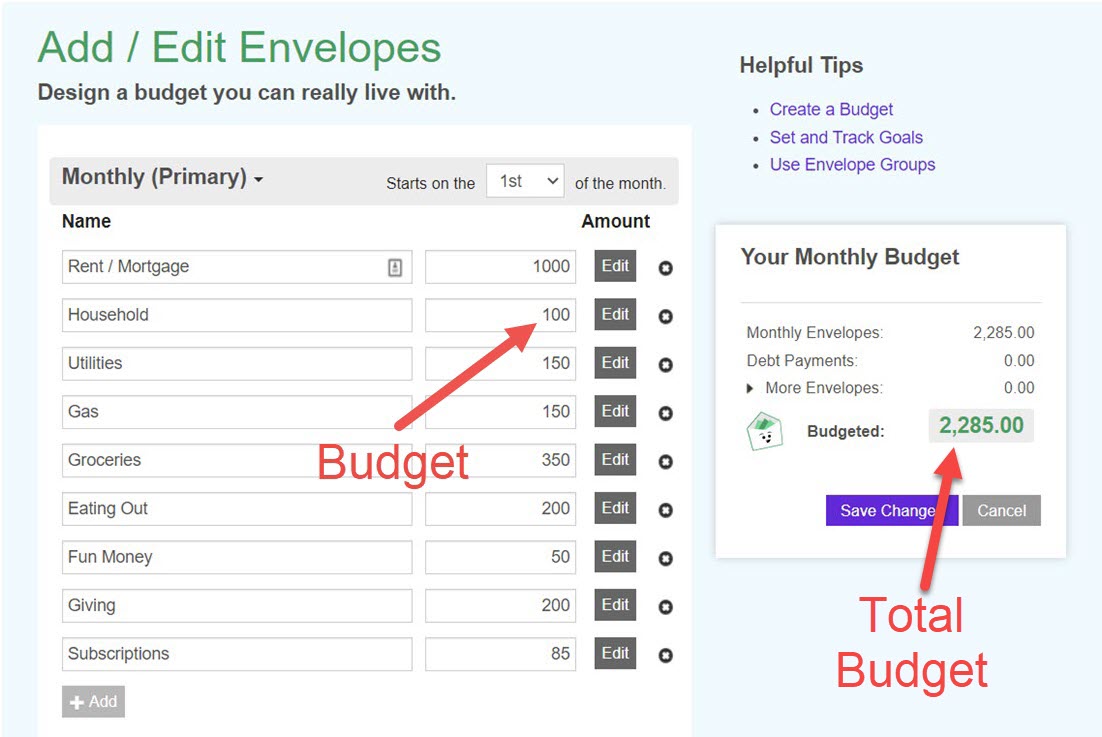

Tally up the total spending for the transactions in each category and then enter that number into the Budget column next to its corresponding Category.

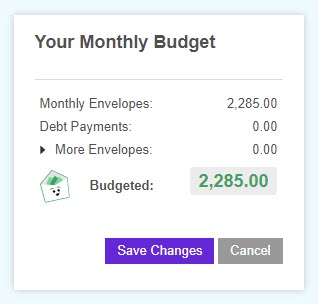

Once you’ve done that, add up all of the budgets to see the total amount you’re budgeting for. Then enter that figure at the bottom of the Budget column. You’ll need it for the next step.

Step 4: Add up your paychecks

So far, you’ve filled in your Category and Budget columns. Now, you’ll need to make sure that what you’re budgeting for makes sense with your income.

Looking at your online bank again, find all of your paychecks from the last month and add them up. Put that number in the Income column of your worksheet next to the total budget amount from the previous step.

Compare your total budget figure with the sum of your paychecks. If your budget is more than your income, you’ll need to cut down on some categories so that your spending is equal to or, ideally, less than your income. Otherwise, you’ll be spending more than you’re bringing in, which won’t be sustainable in the long run.

If your total budget is less than your paychecks, great! You can challenge yourself to create new categories for things like Savings and Giving so you’ll have a place for that extra money.

Step 5: Monitor your spending

At this point, you’re ready to start budgeting with your budget worksheet. Going forward, keep an eye on your spending to make sure that it falls within the limits that you set for yourself in your worksheet. If it helps, you can use a separate tab within your document to record spending so it’s easier to see and tally up.

PRO TIP: Track your budget with an app!

Budget worksheets are fine, but there are limits to how and where you can use them, and they often fall short when compared to the ease and convenience of using an app.

Apps have the advantage of always being right at your fingertips. That means your budget is always with you, no matter where you go! Plus, getting your spending data into the app is often easier than compared to something manual like a worksheet.

That’s where Goodbudget comes in.

Goodbudget is a budget tracker for the modern age. Say no more to updating worksheets (or to carrying paper envelopes, if that’s your thing). This virtual budget program keeps you on the same page as your budgeting partners with the time-tested envelope budgeting method, and it’s all on your phone for convenient tracking. Goodbudget Premium makes tracking your expenses even easier by automatically importing your transactions. No more manually updating huge worksheets on a tiny screen!