If you get paid every four weeks, you’ll receive 13 paychecks over the course of the year. The best way to budget for that is with a monthly budgeting period based off one of your paychecks. This will help you keep a consistent budget month to month and will give you a bonus paycheck at the end of the year that you can use to pay down debt, build up your savings, or simply enjoy!

Budget off one paycheck

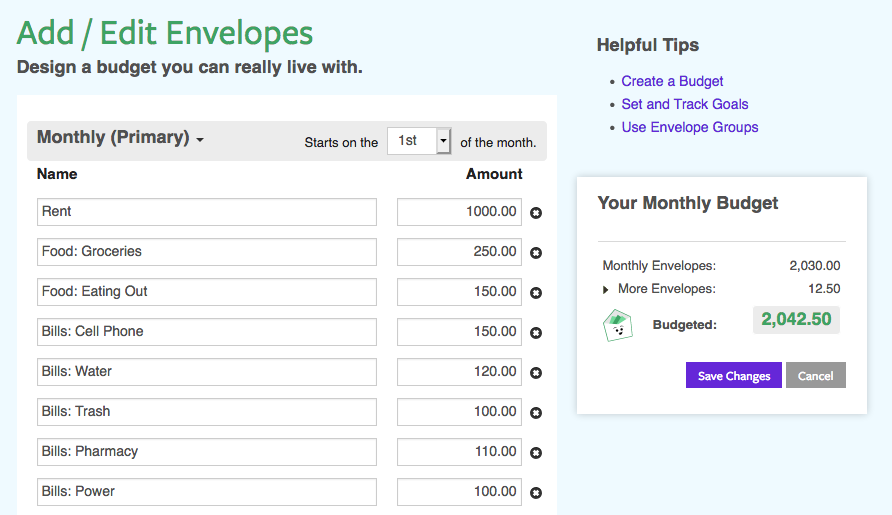

Start by creating a budget based off one of your regular paychecks. To do this, click on the “Add/Edit” button on the Envelopes tab to get to the Edit Envelopes page. Here you can create your Envelopes with their budget amounts. As you create your budget, make sure that your total “Budgeted” amount is less than your paycheck.

Crafting a budget that fits into a single paycheck will likely involve some tough choices, but stick with it! Resist the temptation to include a portion of your next paycheck into your budget, and you’ll be rewarded with greater peace of mind and a budget that’s flexible enough to deal with the surprises that always come up each month.

Not sure how to start? Check out our help article on How to Make a Budget.

Record your income as you receive it

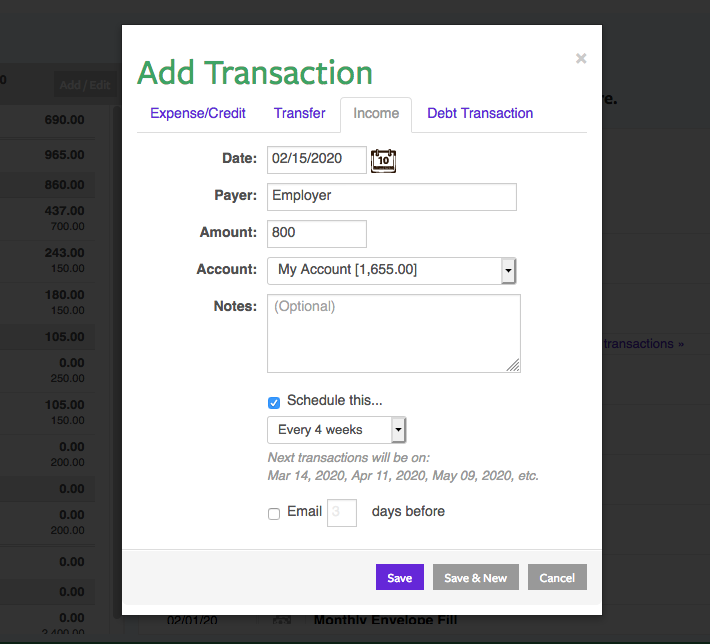

As you receive your income, record it! Click on the purple “Add Transaction” button and head to the Income tab to record your income. The funds you add will remain Available until you distribute them to an Envelope.

Fill your Envelopes once each month

At the beginning of the month, use the Fill Envelopes page to refill your Envelopes.

Enjoy your bonus paycheck!

At the end of the year, you’ll have a whole extra paycheck to use as you like. Enjoy!