Welcome to the fourth week of Goodbudget 30: Break the Cycle! You’re making great progress on building a cushion so you can be free of the paycheck to paycheck cycle.

So far, you’ve picked a way to boost savings, created a budget, started tracking your savings to begin building your cushion, and learned about how to maintain that cushion. Today, you’ll learn how to use your cushion, how to know if it’s cushy enough, and what to do if you use it up.

How to use your cushion every month

Just to recap what your cushion is, your cushion is a cash buffer that you can draw from to pay bills or to Fill your Envelopes to full. When you have a cushion, you’re able to do those kinds of things before your new income arrives, rather than having to wait until after you get paid.

What that means is that this buffer will change. As you draw from it and fill it up back up, its balance will naturally go up and down throughout the month.

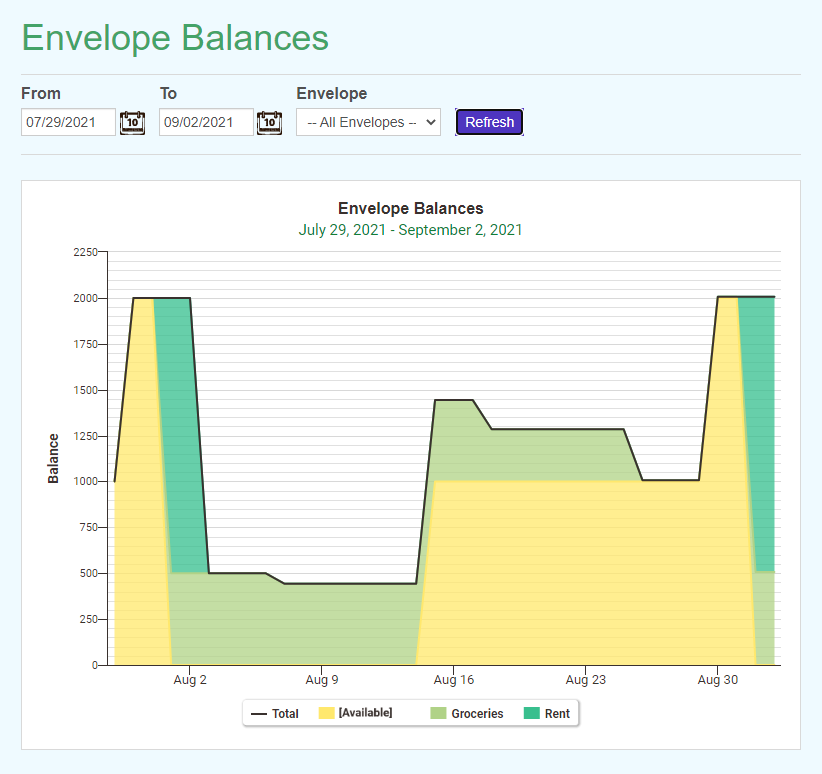

When you Fill your Envelopes in Goodbudget and pull from your Available money, your buffer goes down (and might even go to zero). But then, when you replenish it with money from your paychecks, it will grow back again. Below, you’ll see how that’s illustrated with the Goodbudget’s Envelope Balances report:

In this example, this Goodbudgeter gets paid twice a month: once on the 15th and then again on the last day. As you can see, Available (which is represented by the light yellow section) starts off at 2000 on the left side of the graph, and then drops to zero on August 1. That’s because the person just filled their Envelopes from their Available on that day. Then, around the middle of the month, they received their first paycheck which boosted Available. Then, they got paid again at the end of the month, and that’s where Available peaks again. It immediately goes to zero again signaling that they filled their Envelopes on July 1.

Depending on how much cushion you decide to build, the peaks and valleys that your Available will have might not look exactly like this. But hopefully this graph gives you an example of what you might expect.

How to tell if your cushion is cushy

Having your cushion hit its max level during the month is ideal for long-term financial stability. When you have a full cushion, you’re able to set aside money for all or some of your bills, which means you can do things like buy groceries before your next paycheck arrives.

Therefore, it’s helpful to understand how to tell if your cushion’s balance is at the level it should be.

If you’ve decided to have a one-month cushion, then your Available will probably look like the graph in the section above. It’s a one-month cushion because this Goodbudgeter has the ability to fill up all of their Envelopes (i.e. set aside all the money they need) to cover one month’s worth of budgeted expenses.

Because of that, that Goodbudgeter has an Available that equals about one month of expenses at the end of the month — before they fill their Envelopes.

If their cushion was not looking as “cushy” as it should, they wouldn’t have one month’s worth of expenses in their Available at the end of the month. If that were to happen, they wouldn’t be able to fill all of their Envelopes at the start of the month, which is what we’re trying to avoid.

What to do if your cushion is looking kind of squashed

If you get to a place where you go to use your cushion and it doesn’t have all the money you need (i.e. it isn’t looking as “cushy” as it once did), you might feel the need to build it back up quickly — and that’s definitely a good idea! Again, having a cushion provides financial stability and can help prevent you from taking on debt, over-drafting your bank account, etc. So having a full cushion in place as often as you can is helpful.

If your cushion has been partially or fully depleted — meaning that you’re no longer able to fill your Envelopes to full at the beginning of the month — there are two options you can consider to help you build it back up.

You might:

- Reinstate your plan to boost savings

- Create a lean budget

If you find that you’re frequently depleting your cushion and then having to rebuild it, that might be an indication that you’re budgeting for more than you’re bringing in. And if creating a lean budget or reinstating your savings-boosting plan isn’t working, you might consider shaking up your financial situation even more. You could try:

- Adjusting your living situation so you can spend less (e.g. opt to live with family, or take on a roommate).

- Looking for a new job to boost income.

- Increasing the amount of time you spend on gig work to build a bigger cushion or boost overall income.

Know when to grow your cushion even bigger

It’s also helpful to know when it might be time for you to increase your target cushion amount. A $1,000 cushion might work for you now, but it might not be sufficient in five years after you have kids, buy a house, or experience another life event that increases your normal spending.

Here are few reasons you might want to consider increasing your cushion:

- You’re entering a new life stage or reached a life milestone (e.g. getting married, having a baby, buying a house, etc).

- You’re consistently tapping into the cushion (that might also be a time to reevaluate your whole budget).

- Your paychecks, bills, or monthly expenses are fluctuating more frequently.

- You’re anticipating a big life change that will increase your spending (e.g. moving to a higher cost-of-living area).

When is it okay to use your cushion as your emergency fund?

In the last assignment, we talked about saving for expected unexpected expenses, like car repairs or travel. When you’ve saved up for these kinds of common expenses, you’re less likely to need to pull from your cushion to cover them when they pop up, helping you preserve it for longer.

But even if you’ve saved up, you can never know exactly how much expenses like these can cost. And it doesn’t make sense to preserve your cushion if it means going into avoidable debt or enduring another financial hardship. As a general rule, you should use your cushion whenever you’re at risk of taking on debt, to help you minimize the amount of debt you might take on, or to avoid overdraft fees and late penalties.

Furthermore, sometimes using your cushion is completely out of your control. In the event that a paycheck comes really late, or is a little lower than you thought it would be, using some or all of your cushion makes sense if that means you won’t need to turn to credit cards or loans.

That’s what the cushion is there for, after all!

—-

Again, your cushion is there for you to use when you need it! So while you should be thoughtful in how you use it, do be sure to use it when the time is right, and work to build it back up when it’s low.

Homework

Leave a comment and let us know:

- Your cushion progress! Are you on track for your 30-day goal? What’s helping you to stay motivated to continue working on your goal?

- What strategy would you consider doing to help preserve your cushion?

6 thoughts on “How to Use Your Cushion”

1. One thing that keeps me motivated is visualizing myself doing something I can only do if I finish the goal.

2. We’ve taken on housemates in the past, which brought both some income and lots of joy to our family because of the time we got to spend together.

I’m keeping my eye on my goal. I know that I saved money on groceries and take out this month. I’ve been meal planning. I am willing to take on clients to clean houses of need be for extra cash.

I’ve decided to grow out my hair in order to save $600/year! That sounds more painful than “$50 every other month” and helps me stay focused on my goal.

I’m going to get a bonus at work, and after I get my sewing machine fixed (I’ve been putting it off because it’s more than I can normally afford), I’m going to put the rest towards my cushion. The old Me would have spent it all. I’m really proud of this shift in my outlook on money!

No I am not on track with my 30 day goal, however I am always staying motivated to continue building a cushion because I have had a financial cushion, it provides financial relief for any unexpected expenses, so It gives me a mindset to relax and feel comfortable. The strategy I would use to maintain my financial cushion is finding a better job, taking on extra work and cutting back spending.

Making good progress. To preserve more cushion, I’m getting strict on my own cash allowance. I take out 25% less than I did previously and spare it across the month. Still works OK, which proves that you can save when you really try.

The thing that’s keeping me motivated is wife ,andkids . Have to make better decisions in handling my money etc…..