When you link one of your real-life accounts to a Goodbudget Account, that Goodbudget Account will begin to receive your new transactions from that day forward.

Goodbudget reflects the various stages of your transactions. When you make a purchase on the real-life account, it will take a few business days for your bank to report the transaction and send it to Goodbudget. Transactions may initially appear as pending, and after they’ve cleared in your bank, they’ll be updated in Goodbudget so you can categorize and confirm them into your Envelopes.

But if it’s been a few days since you’ve made some purchases and none of the transactions have shown up in Goodbudget, try following the troubleshooting steps below.

1. Re-link your account

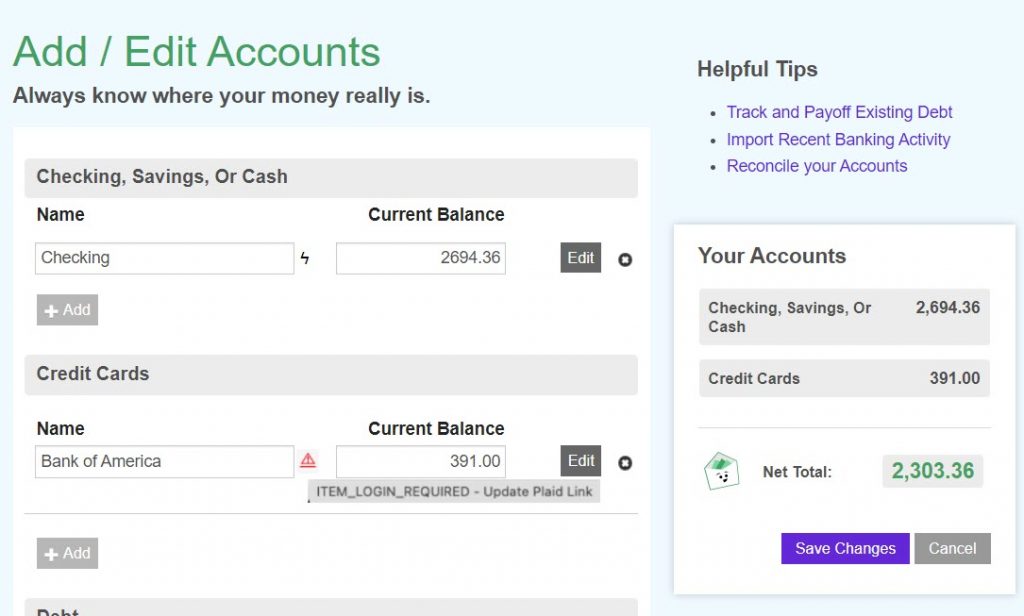

If something’s gone wrong with your connection, you may see an error message when you log in to your Household on the web. Actions like changing your bank password may result in a broken connection. When that happens, you can re-link your account by heading to your “Add/Edit Accounts” page, and then clicking on the triangular error icon to re-enter your bank credentials.

The error may still be visible after re-entering your credentials. But if the re-link is successful, the error icon should disappear the next day and you should start receiving new transactions again.

2. Check your bank settings

Every bank has its own policies for how to handle third-party apps that request access to a customer’s transaction data.

If your new transactions aren’t showing up in Goodbudget and you don’t see an error message on the “Add/Edit Accounts” page, you may need to explicitly tell your bank to allow transaction data to be sent to Goodbudget.

Head to your online bank and check for a ‘Manage Connected Apps’ or a similarly-phrased section of your bank’s website, and approve Goodbudget (or Plaid) so that your transaction data is shared.

Once you’ve approved Goodbudget, you should start to receive new transactions going forward.

If you don’t see an error and you’ve checked your bank settings, you can try re-linking your account by clicking on the lightning bolt icon next to the Account name.

3. Here’s when re-linking or bank settings won’t work

There are some actions that may result in a broken bank connection that can’t be resolved by re-linking your account, or updating bank settings.

For example, canceling an existing card that you’ve linked in Goodbudget due to fraud activity will result in transactions not syncing correctly because of mismatched data.

When that happens, you’ll need to unlink your existing bank connection and create a new one that has the matching data Goodbudget expects.

Here’s how you can create a new connection on the website:

- Click to the “Add/Edit” button on the Accounts tab

- Click “Edit” next to the Goodbudget Account that’s connected to the affected institution

- Click “Unlink Account” > “Add Bank Connection”

- Follow Plaid’s prompts to enter your bank’s username and password

- When you get to the step where you select which bank accounts you’d like to share with Goodbudget, be sure to select all of them at the same time

- When you’re redirected back to the “Add/Edit” screen, click the “Link to Bank Account” dropdown to select the bank account associated with your new connection

- When you’re done, be sure to save your changes

Once you’ve created the new connection, Goodbudget should be able to sync your transaction data again.