Track debt on the web

Debt Accounts are now available on the web, so you can more easily track your debt payoff progress. These Debt Accounts are great for tracking things like car loans, student loans, and credit cards you’ve stopped using and are working to pay off. When you track these kinds of debt with a Debt Account, you’ll see a red bar with the amount you still owe on your debt, so you can quickly see your payoff progress.

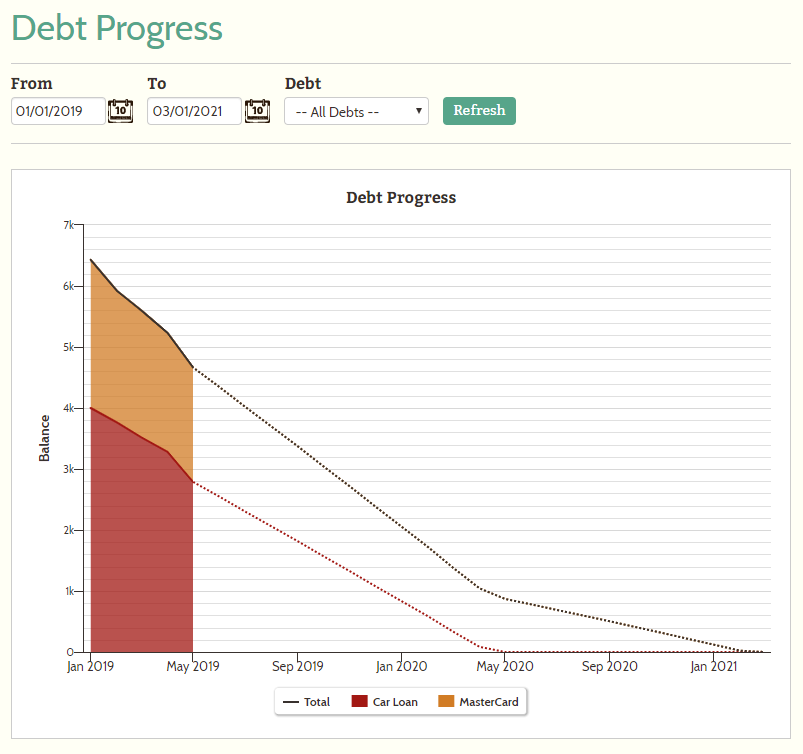

This web update also includes a new Debt Progress Report. This report shows your payoff progress for all of the Debt Accounts you’re tracking, and also calculates the expected payoff date for each of those Accounts.

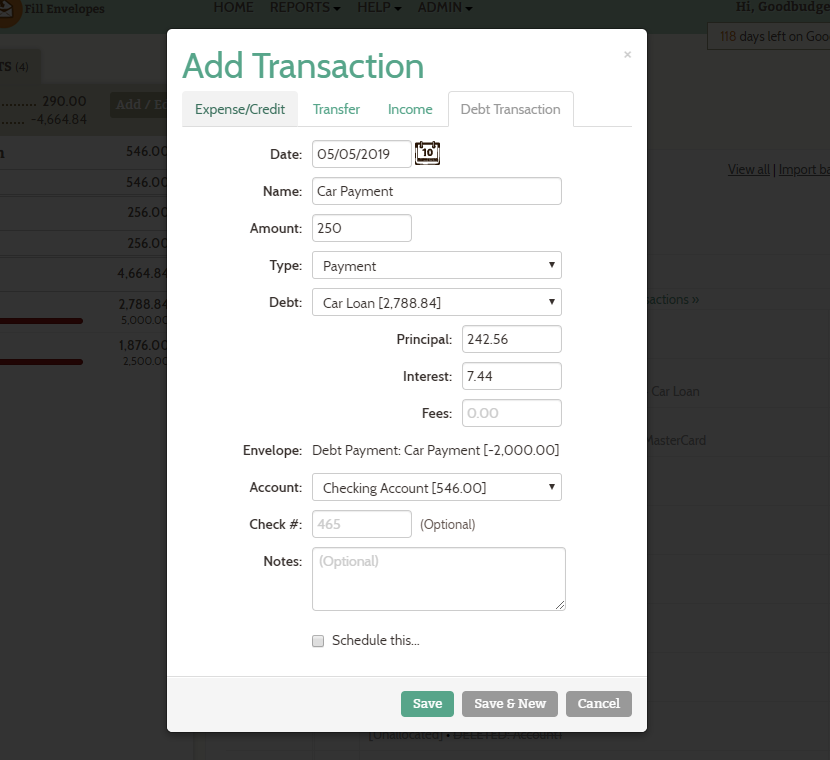

Finally, you can make payments on your debt in one easy step.

How to get started

If you currently track your debt payoff in Goodbudget, but haven’t gotten started with the new Debt Accounts and would like to, check out our resources below to find the appropriate article to help you transition to these new features.

If you’ve been tracking debt payments with Envelopes only, see how to get started with Debt Accounts here.

If you’ve been using Debt Balance Envelopes to track your debt, start here.

And, finally, if you haven’t been tracking your debt payoff progress in Goodbudget at all, you can see how to get started here.

Happy budgeting,

-The Goodbudget Team

10 thoughts on “Web: Use Debt Accounts to Track Payoff Progress”

Great feature, thanks for adding!

Glad to hear you’re liking the features 😀

Love this feature, and hope to see it in the app soon!

Question: how do I remove a debt account permanently from my account so it does not appear in the Debt Progress. I accidentally made duplicates.

Hi Adan — if you delete all transactions associated with a Debt Account, it will stop showing up in the Debt Progress Report. Just have a look through your transactions list for any transactions that were part of the Account you want to remove, click on them to open the edit menu, then click on Delete.

Is there a way to hide a debt account and it’s associated envelope one the debt has been paid off? I would prefer not to see it in my list, but I don’t want to lose the transaction detail.

Hi Heather — if you’re done using the Debt Account, you can delete it and the associated Envelope. Deleted Envelopes and Accounts will be removed from your lists, but their associated transactions will remain in your household history and Reports.

Can I use a Debt account to track receivables? I have a loan to my company. Can I use a Debt account with a negative balance?

Debt Accounts are designed to track debt that you owe, not track that you are owed. Hope that helps!

Thanks for the note. However, it works. Just enter the amounts as negative and now you have tracking of a debt owed to you. Aloha