If you’ve linked multiple accounts with Goodbudget’s Premium plan, you may find that you have two automatically-imported transactions that represent a single real-life transaction that occurred between the two accounts.

For example, if you’ve linked both a checking account and a credit card account to Goodbudget, you may end up with two transactions, a credit and an expense, that represent your credit card payment.

Use Goodbudget’s Match tool to merge those entries together! Here are some options on how you can do that.

Option 1. Match Your Payment and Credit into an Account Transfer

In a case like this, you can use the Match tool to merge these two imported transactions into a single Account Transfer that will represent your credit card payment.

You’ll do that by clicking on the icons to the left of the date to select the automatically imported transactions, and then by clicking on the ‘Match’ button near the upper right corner of the screen. See below:

Once the transactions are matched, they’ll be renamed ‘Account Transfer,’ but you can edit that to something more specific afterwards.

Option 2. Match Your Converted Account Transfer to Your Synced Transaction

Each bank has its own schedule for when it allows Plaid to check for new transactions. For you, that might mean the transaction coming from your linked checking account might sync down before the transaction from your credit card account, or vice versa.

In that case, you can convert the transaction that syncs down first into an Account Transfer while you confirm it. Then, when the other transaction syncs down, use the ‘Match’ tool to merge the synced transaction with the manual portion of the Account Transfer.

Here’s how you’d do it:

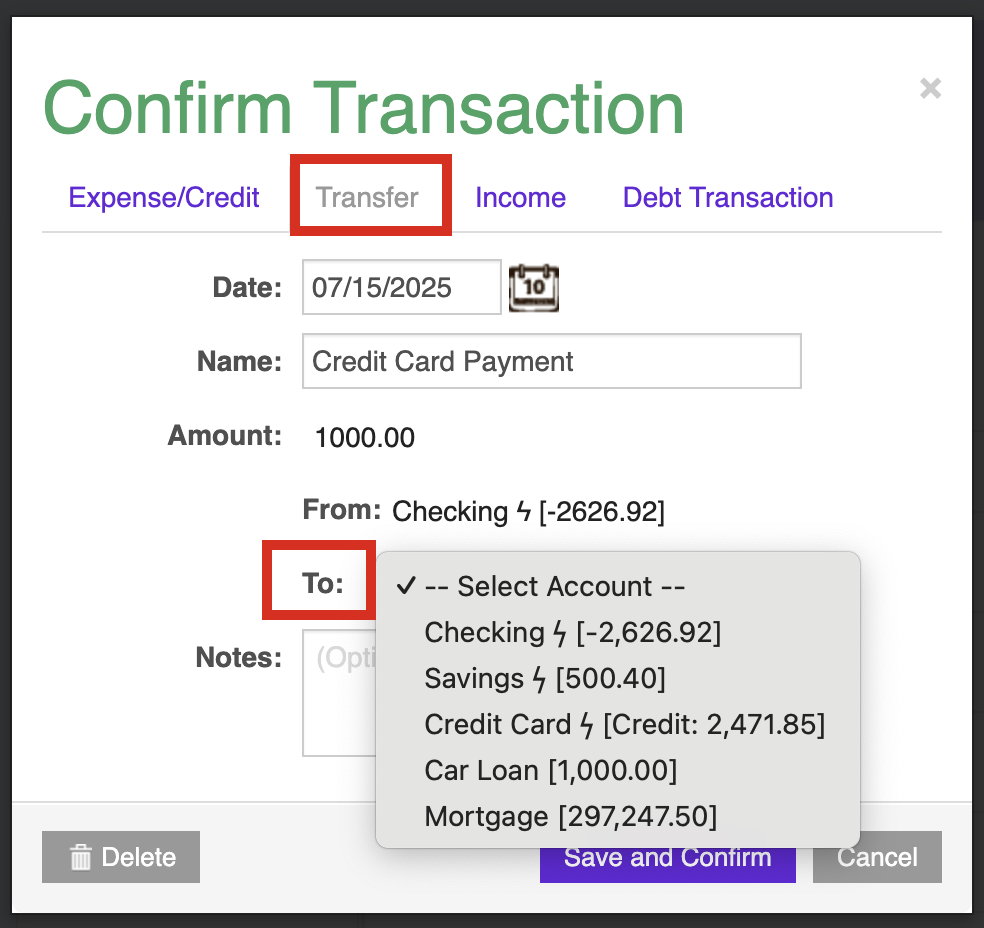

Step 1: Confirm your first transaction as an Account Transfer

When the first half of your payment syncs down, convert it to an Account Transfer. If the transaction is negative, you’ll convert it into an Account Transfer by clicking on the ‘Transfer’ tab at the top of the ‘Confirm Transaction’ module, and then selecting which Account the funds are going to. If it’s positive, you’ll select ‘Transfer’ as its type first before selecting which Account the funds came from.

Step 2: Match the other half of the payment when it syncs down

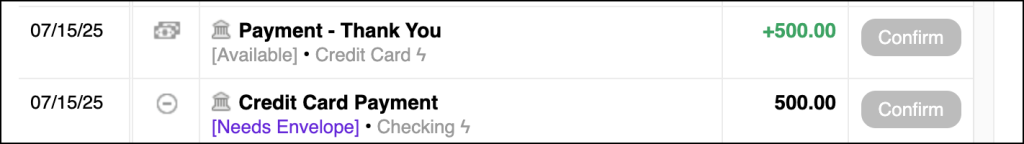

Finally, when the other half of your payment syncs down, match that item to the half of the transfer that has the same sign. See below:

Alternatively, you can delete the second transaction that syncs down, instead of matching it to your existing Account Transfer.

Already converted your synced transactions into multiple Account Transfers?

In that case, you’ll need to manually delete one of the duplicate transfers. Account Transfers created from automatically imported transactions cannot be matched together.