Stage 1: Survive

This stage is all about surviving the here and now. To do that, you’ll need to start by acknowledging the situation you’re in so that you can develop a plan that makes sure you can pay for the essentials, like food and bills.

You know you’re in this stage when you’ve:

- Lost a job or main source of income,

- Had a significant cut in hours that impact your ability to pay for essentials, or

- Hit some other big financial troubles, like a hefty medical bill.

You’ll be out of this stage when you’ve found a way to pay for food, shelter, and other essentials for about a month.

Now, the road ahead might be long, tough, and tiring, but it’s not impossible. Often, when financial emergencies strike, all we hope for is to find a way through the storm so we can see the sunshine on the other side.

Meet Josh & Ashley

A financial emergency is just about to strike our fictional family. Throughout the rest of this course, you’ll see how they survive, adapt and even thrive through their crisis.

Meet the family. They have two kids, Ava (8) and William (5). Ashley works full-time and Josh part-time. When Josh isn’t at work, he takes care of the kids. He loves spending time with them, and appreciates the extra time at home to nurture and care for his family.

With steady incomes, Josh and Ashley have always paid their bills on time, so they’ve never felt the need to follow a set budget. They’re aware of their bank account balances and make sure they always have enough to pay their monthly bills, like rent and their car payment, and have a little leftover for fun and leisure. But even though they always pay their bills on time, the downside to not following a set budget is that they’re living with a paper-thin margin and don’t have a one-month cushion to fall back on if an emergency were to happen. But because they’ve been fine so far, they haven’t stressed about it too much.

Unfortunately for them, an emergency strikes. Josh loses his job and now they’re being confronted with just how narrow their margins have been. His job loss is a major financial blow. Even though they’ve lost income, bills still need to be paid, they still need to eat, and they still need to feed the kids. They’ll have to find a way to survive this unsettling emergency.

The crux of their emergency is they only have a small bit of savings. Because of that, they know they need to make some major shifts so that they can buy food for the rest of the month and pay rent when the new month starts. Without family around to help support them, they know the only way they’ll be able to get through this is if they take a serious look at how they’ve been spending and make some quick changes to survive their current emergency. They decide to start by taking a look at their bank accounts to see how they’ve been spending over the last 30 days. They hope that by seeing how they’re currently spending, they’ll find some quick areas where they can pull back. Here’s how they’ve been spending over the last 30 days.

It’s a little surprising just how much they’ve been spending, but at least now they have an accurate picture. They also add up their income to see what they’re bringing in. Immediately, they see that they’re spending almost exactly the same amount as they’re bringing in, and it makes sense why they couldn’t save or build an emergency fund. They know they need to start tracking their spending more carefully so they can make sure they’re living within their means.

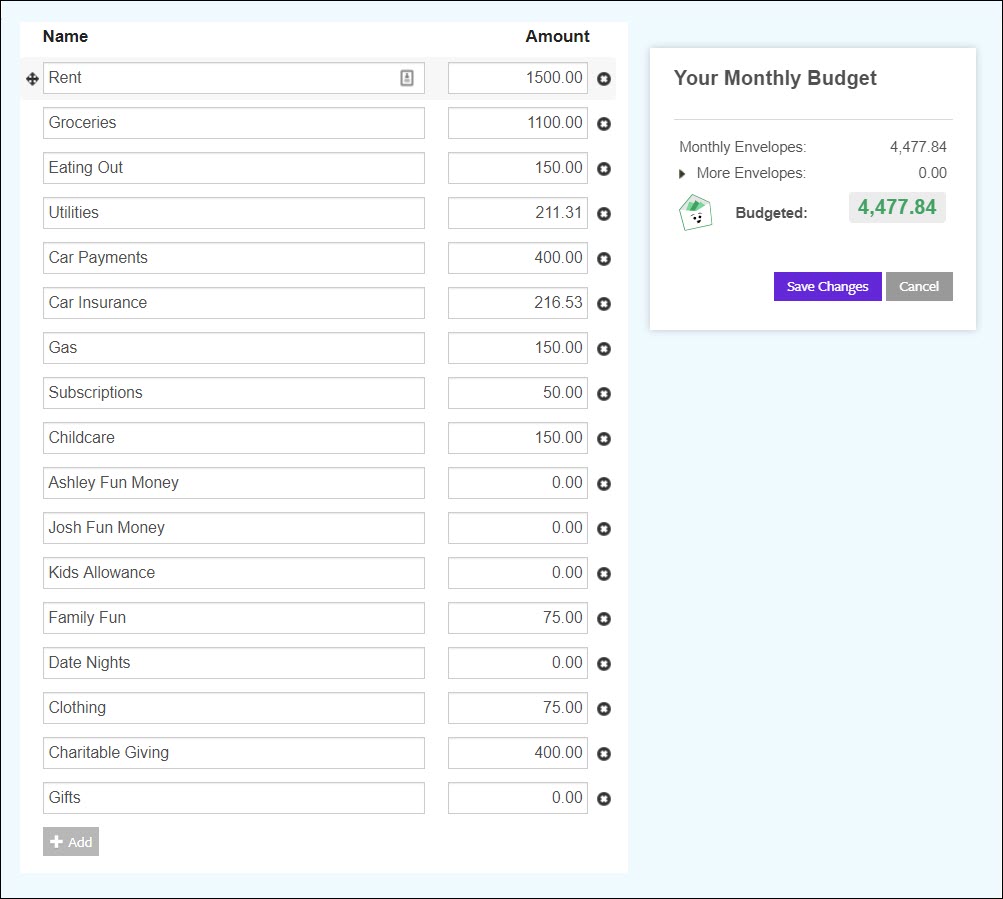

What they need is a budget that helps them spend less than they’re earning. To help them make ends meet while Josh looks for another job, they plan for Josh to apply for unemployment benefits. Even with those benefits, they’ll have less income overall to work with each month, so they really have to pare down their spending. Here’s what they come up with:

As you can see from their new budget, Josh and Ashley have decided to reduce and cut out a lot of things from their budgets, and they plan to continue this way until they’re back on their feet. But they know that things won’t be easy. This is a major shift from how they’re used to spending.

Now that they’ve created a spending plan, the next step is to figure out how they’ll pay for bills that will be due soon. Ashley won’t be getting another paycheck for two weeks, and Josh’s unemployment benefits will take some time to kick in. Based on their checking account balances, they don’t have enough to pay for food for the family and for the bills that are coming due soon. So they take a look at their savings. They have a small amount of savings and then a bit of money set aside for a future vacation. While the total amount is small, it looks like it should be enough to cover food and rent when the new month hits. That’s a relief! They’ll at least be able to keep a roof over their heads. They decide they’ll make a plan to set up late payments with their utilities companies, which they’ll pay when Ashley receives her next paycheck. They’ll feel a little more relief when those unemployment benefits kick in.

With some quick action, Josh and Ashley feel like they’re going to be okay for now, but they’re not out of the woods yet. A lot of hard work and planning still lies ahead for them. Fortunately, this was a huge wakeup call for them. Being confronted with where they’re actually at financially is a turning point for them, and they’re ready to put in the work to make themselves financially secure for the first time. Long-term, they hope to get to a place where they can be prepared for future emergencies, and you’ll see how they reach that point in the coming weeks. But, for now, they’re just relieved to be able to provide for their family.

Comment below and let us know

- What about Josh and Ashley is surprising to you?

- What about their story do you relate with?

42 thoughts on “How One Family Survived a Job Loss”

I think it was smart to bite the bullet and make quick cuts, even though it hurts. Getting on payment plans for bills is a good tip too! Ashley and Josh sound like they’re working together as a team, which is huge.

Yes they working hard and I’m going to do the same.

Empowered by utilizing good budget making a logical decision. Removing emotional impacts with facts.

I’m surprised with how much they’re still giving to charity. I understand its a great thing to do, but I feel like they could have cut that in half. Other than that amazing work at making the cuts needed to get through the month!

Thanks for sharing Kimberly! It does seem surprising, but it sounds like giving in particular is something Josh and Ashley really value.

Agree with that comment

Cutting down on the charity category would have made some difference on their budget, at least for now.

Yes they working hard and I’m going to do the same.yes cutting down on charity.

I’d say! I was surprised about that. That charity budget seems like a lot while you’re cutting on groceries and eating out for the family ….

It surprised Me that they have been and not on a budget for so long and what I can relate to them is not really knowing where my money is going and especially not having a savings account or Emergency fund

Thanks for sharing, Cyndi!

I can relate to this, especially now with pandemic going on.

They did great to have two kids and one person in the home is work, and they did it on one income. Iris.

Yeah, that definitely takes work and sacrifices!

I think I was surprised by how much was being spent each month and it’s making me want to go through my own statements with a fine tooth comb. I know I have definitely spent frivolously even when I couldn’t afford it. So I’ll need to make that change.

I can relate to the stress of finding money to meet the needs. I was surprised by how much they cut their expenses and agreed on this and working together.

I can relate to have a small margin between how much I’m spending and bringing in. My family lives paycheck to paycheck with no savings. I’m surprised that they didn’t decide to stop giving to charity for a while.

It surprises me that their car payments are only $400 for two cars & even more surprised that the car insurance is only $216.52. I can relate to them just now realizing that they should of created a budget a long time ago and wanting to be secure for the future

1. To see how much they shaved off their expenses.

2. I seem to have been living like this off and on my whole adulthood. Never saved. No cushion. Living outside my means.

Well it all depend on what is important and what is not, Like food for family of four over date night. Buying food instead of eating out. it all about survival

What I found a little surprising is that even though they have money for family fun, they still have money to have fun separately and also money for date nights. I understand they have a social life outside of their family but I can’t help thinking they were speeding to much money on fun.

What I relate to about their story is their emergency looks exactly like mine, I lost my job recently, found another one but payment won’t come until next month and I still have bills to pay.

There is nothing surprising about Josh and Ashley but the fact they can cut back and sort their situation for the meantime is just what I need to be able to do currently.

I think they should have cut out fun money and date night all together and stayed hime for fun and games and date night could be done at home as well. Until they get back on their feet.

I definitely relate to big cut in pay, living paycheck to paycheck with no savings or cushion

I think making the budget will keep them accountable for the in & outs of their account, which is what my husband & I want to do now.

Some comments say they kept date night but they stopped spending on date night which is what my husband and I do. We are at the point where spending money on dates is not a top priority. Giving is a wonderful thing to do but feeding your family and having a roof over their heads is more important but if they can swing it then cool. It works for them.

Our situation is different. I have four children so we’re a family of six with the same income that this family has after making their cuts. We pay 200 more in rent, the same amount for one car payment, 100 less in car insurance, way more in eating out(which is where our problem is and could probably do much better financially by cutting that out completely. It’s so hard with four kids who are picky eaters!) and having a monthly budget for family fun is way out of the question right now. We try to do that for free. Anyway, looking at their budget and making some adjustments to mine, I think we can make it work.

Groceries have gone up quite a bit but at least I’m not spending much money on gas since I had to resign from my job. What do you all do for groceries when you have picky eaters and the rise in grocery prices during this crisis we are in?

Thanks for sharing, Brandy! I resonate with a lot of what you’re saying, but I recognize that my situation is different than yours. My husband and I voluntarily went down to one income starting in September of 2020 so he could go back to school to start a new career path. We’re now back to two incomes, so we’re not necessarily on a lean budget, but we are trying to pay down the debt that we took on for his schooling so we’re still trying to be aware of how much and where we’re spending. Anyway, when we were living on one income (which wasn’t enough to cover all of our expenses even though we cut back), Groceries, Eating Out and Discretionary were the big expenses that we cut back on. I’d say my husband is a picky eater, so it was definitely a challenge to stay on budget and still make interesting food that wasn’t too repetitive. I don’t know if this is helpful for you, but one thing we tried as a family was to sit down and plan the weekly menu together. That way, there was buy-in from everyone since we were both giving input and choosing some items for the week.

I like being able to see where they were able to make cuts in their budget, there’s a couple areas I feel I would have chosen somewhat differently, but it is definitely realistic that they did not cut out all the “fun money” they kept a family fun part in their budget. I try to do that with myself because it’s unrealistic that I would be able to cut out all extra expenses

Sound about like my family right now. I run a small home based business and just lost my part time job. I didn’t figure in my husbands side job money or my business money as steady reliable income. Hopefully when that extra money comes in from our side hustles, we’ll already be in the mindset of better spending habits and that extra cash can help us get ahead and caught up, as I already feel like we’re starting out with behind on everything and playing catch-up.

I was surprised that Josh and Ashley completely cut their children’s allowances.

I can certainly relate to their complete lack of a budget. When I was working I always had enough income to cover my exorbitant spending but now that I am retired, I desperately need a budget to live within my new, limited means.

It’s good they don’t have consumer debt to add to their worries, like BNPL schemes. That’s the last thing amyone wants when you’re struggling financially.

They are like the majority of the families including ours. I was surprised on some of the budget items they kept but understand their plan. How, is this like ours, we couldn’t cover an emergency without robbing Peter to pay Paul.

The charity surprised me, I think they are giving more than they can afford

i can relate to ashley and josh’s story. that is us – spending everything and saving nothing. i am excited to have a budget and goal that my husband and i can work towards together to move from surviving to thriving.

It’s an interesting budget for this family.

Looking at their expenses and where they cut back has certainly given me something to think about.

It was such a good thing that the couple had no credit card debt,but did have enough savings to help them survive the emergency. If the charitable giving was a tithe at their church, it is understandable that they valued their word and their church highly. However, if this was the case, perhaps the pastor might encourage a “Paymenet Plan” temporarily, until the husband is employed. If not a tithe, then perhaps they could pare the amount down temporarily by selecting one charity to support until things are better. The balance could then be put in savings.

I was basically doing well with money in checking and savings. I am retired now and want to make a budget to live by. I now have only one income and must do what they did. I like how they restructured but still took into account what is important to them as a family.

I would cut back with groceries and the amount of contributions. I’d cut out date night and spending change for both.

Stringent measures are crucial, especially if it involves meeting basic necessities. …’don’t bite more than you can chew’ in my opinion.

The grocery bill is still pretty high, I think. It’d be nice to find ways to lower it a bit more. And I tend to think that it’s best to chose between eating out and family fun and cut one of the two.

I relate to them in a sense that I think they did well to secure their roof, and put food on the table for that month, especially for the kids. In the midst of crisis, I quickly pay the rent. It’s high on my list.

I applaud them for getting on plan together.

I know it was over 4 years ago that their budget was set but they must not live in California. Our rent at that time was $5000 (that landlord is now charging $6500 for his 1600 sq ft home). Now everything has gone up in price tremendously. Any chance you have a recent example for someone in California? Kudos to them for factoring in such generous giving when they are hurting financially. I imagine they are giving to other families in deeper need.

Hi April – Thanks for your post! Factoring in averages of certain expenses, and inflation, you might expect a California emergency budget to look something like this:

Rent – 3000

Groceries – 1400

Giving – 500

Car Payments – 750

Eating out 180

Car Insurance – 220

Utilities – 250

Gas – 180

Subscriptions – 60

Childcare – 180

Family Fun – 90

Clothing – 90

Keep in mind that the cost of living varies a lot, even in California, so use this only as a starting place to guide to your own budget.

I was extremely shocked at how much they give to charity. I have never been financially stable enough to do this. My biggest issue is that I over spend on “wants” before I save and spend on my needs.