Welcome back to GB 123: Be Debt Free! So far, you’ve made a list of your debts, and used that list to help you add Debt (and regular) Accounts to your Goodbudget so you can start tracking your payoff progress.

In today’s assignment, you will:

- Create a budget that prioritizes paying down debt.

- Start building your “snowball” payment, which is the gap between your planned expenses and your income. This snowball is essential in helping you crush your debt as fast as possible.

In case you need it, here’s a reminder of where you’re at in the Debt Snowball process! The solid check mark shows what you’ve done, and the dotted check mark shows what you will complete in this particular assignment.

![]()

Why do you need a budget?

Sure, it might be possible to pay off debt without a budget, but it’s certainly a lot harder. By creating a budget, you’re telling yourself ahead of time what’s important when it comes to how you spend and save.

By creating a budget, you’ll be able to craft a spending plan that prioritizes paying off debt. So you’ll not only need to create a budget that equals less than your income, but you can also look for ways to cut expenses where possible to give yourself the biggest snowball you can. Having the biggest snowball possible means you’ll be paying down debt as fast as possible.

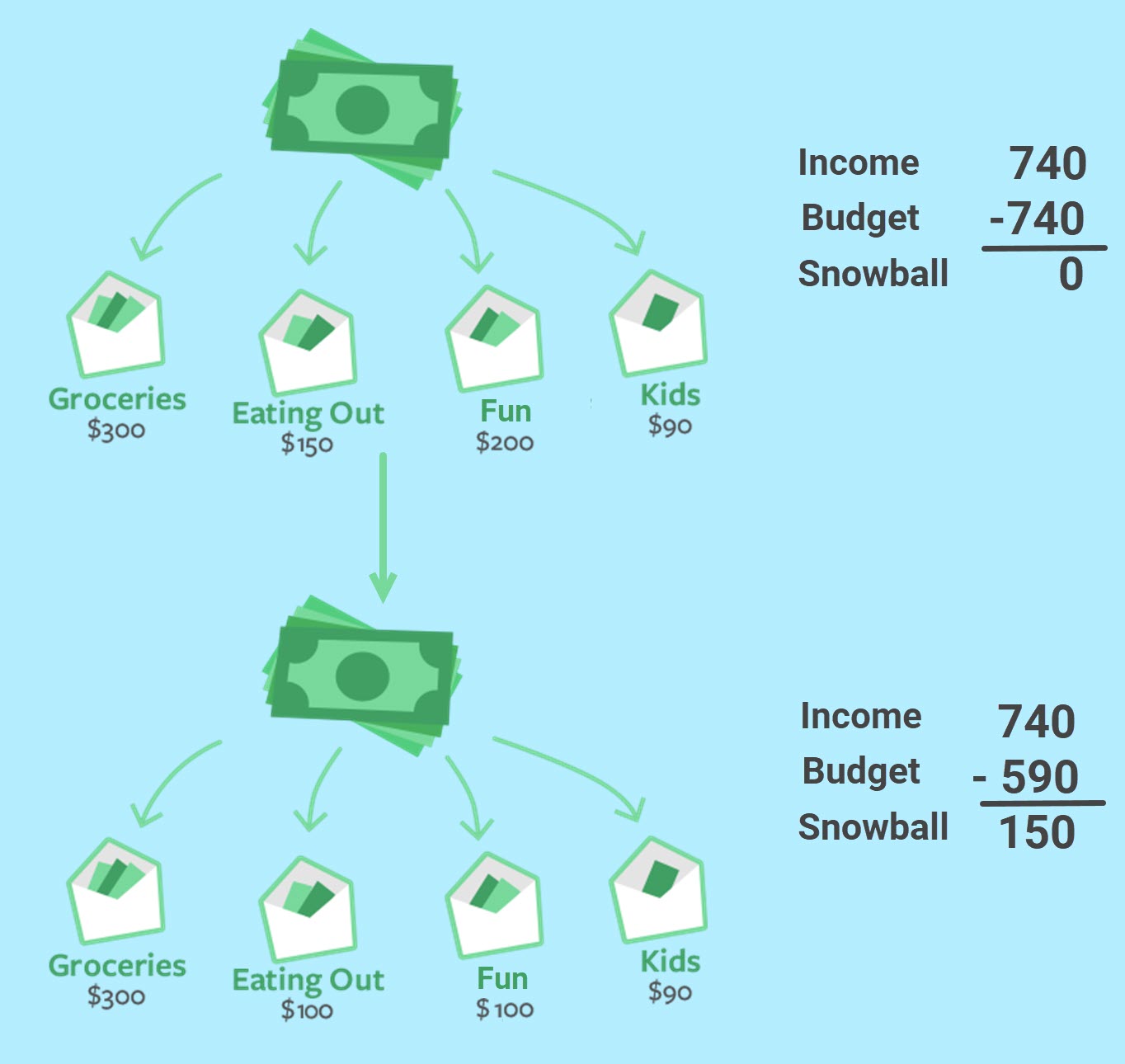

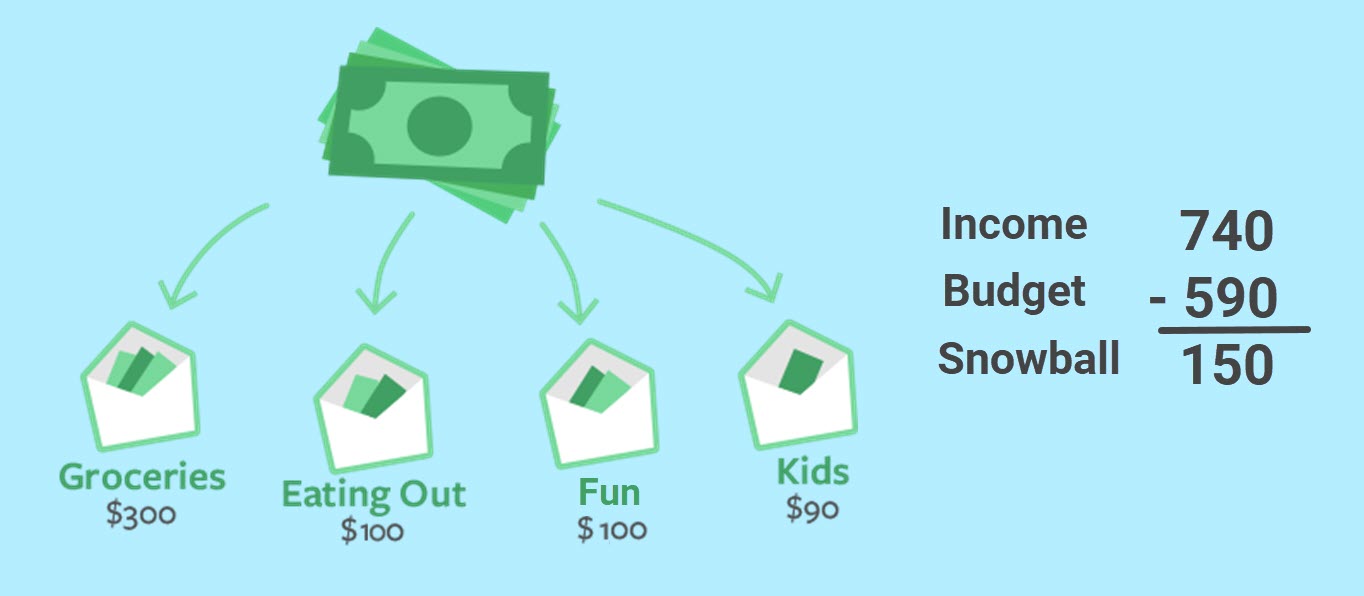

Here’s a visual explanation on how cutting expenses where possible helps you maximize your snowball payment.

Homework

Create your budget

If you already use Goodbudget…

You’ll most likely only need to update your existing budget to make sure that the total amount you’re budgeting for is less than your income.

- Find your income amount: Head to the Income by Source report to see how much you bring in each month, and write down that number for reference in the next step.

- Maximize your snowball by updating Envelopes: Go to the Add/Edit Envelopes page and find your total ‘Budgeted’ amount (located on the right side of the screen in green). If that ‘Budgeted’ figure is equal to or more than your income, you’ll need to update one or more of your Envelopes’ budgeted amounts so you’re budgeting for less than what you’re bringing in. The goal here is to have the biggest possible gap between your planned expenses and your income. That will give you the biggest possible snowball to use in paying off your debt.

- PRO TIP: To help you prioritize debt payoff, consider cutting out or reducing things like Fun, Eating Out, or something else for just one month and see if you can live with that change. If you can’t, add it back to your budget, and make an adjustment somewhere else. Creating a realistic budget is all about experimenting to figure out what works for you!

- Save your changes: Once you’ve finished making changes to your Envelopes so that you have the biggest snowball possible, be sure to save those changes.

If you just signed up with Goodbudget…

There are a few more steps to get your budget up and running since you’re just getting started.

- Find your income amount: First, head to your online bank(s) and tally up your monthly income and write it down. You’ll need that number to help you craft your budget.

- Create Envelopes to shape your snowball: Go to the Add/Edit Envelopes page to start creating your Envelopes. Keep in mind that the goal when creating your budget is to have the biggest gap between your planned expenses (aka, your ‘Budgeted’ amount) and your income, so work to create a budget that equals less than your income. That gap is your snowball.

- NOTE: You won’t need to create Envelopes for your monthly debt payments since you created Debt Accounts in the last assignment, and connected those Debt Accounts to [NEW] Debt Envelopes.

- PRO TIP: If you’ve never made a budget before and aren’t sure where to start, learn how to create one based on your past spending or based on your income.

- Save your changes: Once you’ve finished making changes to your Envelopes so that you have the biggest snowball possible, be sure to save those changes.

Find your snowball

Now that you’ve created your budget, you’re now ready to finalize your snowball payment and add it to your Debt Envelope’s budget.

Karisa explains that you can figure out how much your snowball could be by “figuring out how much you’re bringing in per month and how much you’re spending. That difference is your snowball.” Pretty simple!

- Find your snowball: Since your snowball is the difference between your income and your planned spending, simply subtract your budgeted amount from your income (both of which you found in the previous step) and that’s your snowball! Write that number down for the next step.

Now that you know what your snowball payment is, next, you’ll add that snowball amount to your smallest Debt Account’s monthly payment. Here’s how:

- Update your Monthly Payment: Head to Add/Edit Accounts page and ‘Edit’ your Debt Account that has the smallest current balance. Then, increase the existing monthly payment by the amount of your snowball. This sets you up to pay more than the minimum so you can pay off this debt faster.

- NOTE: If you have any scheduled Debt Transactions for that Account, be sure to update the amounts.

- PRO TIP: You can review your debt progress by visiting the Debt Progress Report. Now that you’ve added your snowball to your smallest loan’s budgeted amount, your Debt Progress Report will show you a projection of when that first loan will be paid off. Take a look at it now before you make your first payment, and then take a look at it after you’ve made your payment so you can see the change!

That’s all for today! That might have felt like a lot, but creating a budget that makes space for debt payments is the best way to make sure that debt payoff is a priority.

In the next assignment, we’ll show you how to “fill” your Envelopes so you can start recording your expenses against them. That way, you’ll be able to add your real-life snowball payment when it comes time to pay it.

Discussion

When it came time to update her budget to gear up for debt payoff, Karisa said she reduced her budget for Envelopes like Groceries and Fun.

We want to hear from you! What kinds of adjustments did you make to your budget? Or, if you’re new to budgeting, how easy or hard was it to make a budget that felt doable but also gave you space for your snowball?

1 thought on “Create Your Budget to Build Your Snowball”

We budgeted more for kids’ extracurriculars than we actually need, so that change shouldn’t hurt too much.