Welcome to the first official assignment of Goodbudget 123: Be Debt Free! We’re so excited for you to start your journey towards paying off debt. We know it won’t be easy, but we believe you can crush your debt for good!

Last time, you got an overview of what to expect in this course. In today’s assignment, you will:

- Learn more about the Debt Snowball method.

- Create Accounts in Goodbudget to start tracking your debt payoff progress. (Remember that list of debts you made in the last assignment? You’ll use it for this step!)

In case you need a reminder of where you’re at on your Debt Snowball journey, you can refer to the Debt Snowball Progress Tracker in each assignment to help you keep track.

![]()

Before you dive deeper into today’s lesson, let’s hear from Karisa, who shared her story of tackling her debt on The Goodbudget Way podcast.

“I was nervous starting my debt payoff journey, and thinking about paying off my debt felt overwhelming. I didn’t actually think I could even do it. But what helped me was actually looking at different debt payoff strategies, because I didn’t even know what was out there.”

You might feel similarly to Karisa. Feeling overwhelmed or nervous about tackling debt is totally normal! We get it! But you might also find that carefully planning your budget and creating your debt payoff plan will help to motivate you and ease any concerns, just like it did for Karisa.

Debt Snowball: An in-depth look

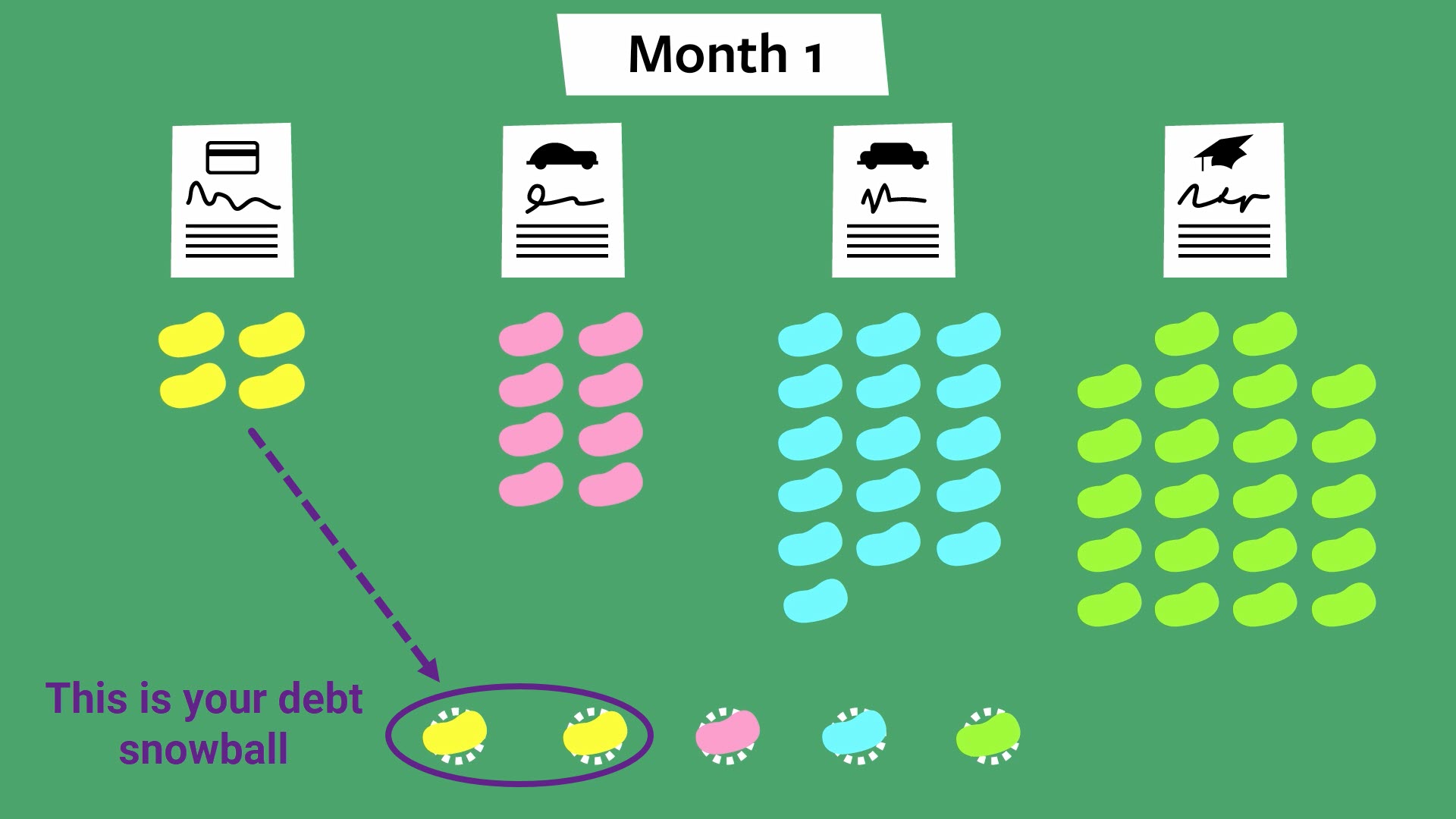

Remember, you’ll be using the Debt Snowball method to help you crush your debt. Here’s a detailed look at how it works, using jelly beans.

- Pay as much as possible on your smallest debt first

You’ll start by putting all your extra money (i.e. your snowball payment) towards paying off your smallest debt first while still paying the minimums on all your other debts.

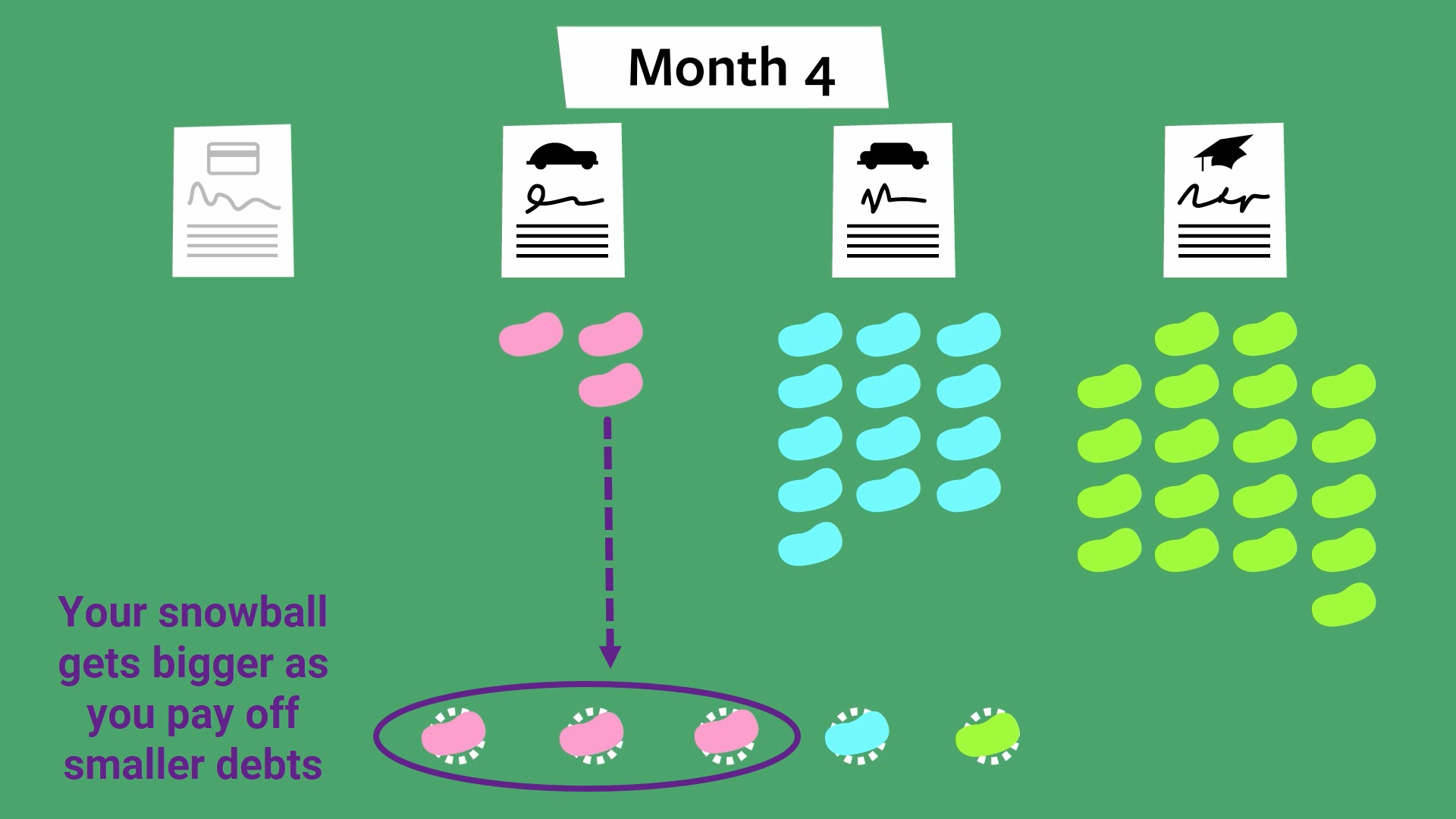

- Pay off your next smallest debt with your bigger snowball

Once your smallest debt is paid off, you’ll throw everything you can toward paying off your next smallest loan, while still paying the minimums on everything else. You’re not paying on the first debt anymore, so you’ve got more money to roll into a snowball to throw at your new target. And your snowball will keep getting bigger as you pay off each debt!

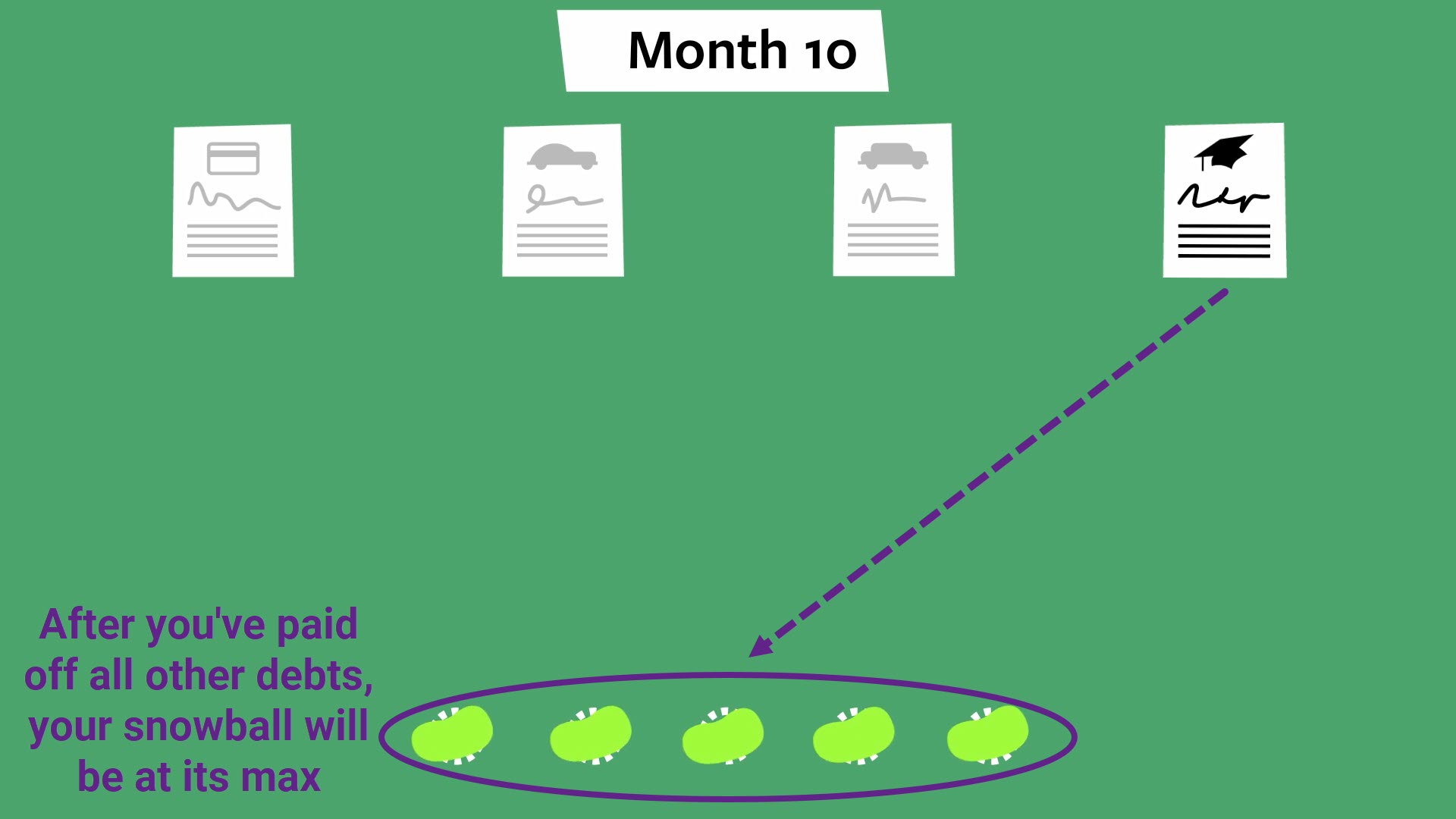

- Keep going until you’re debt free

Keep working on paying off your next smallest debt until you’ve paid them all off. And when you’re done, remember to celebrate! (If you want more info about how Debt Snowball works, check out this more detailed video explanation.)

Why Debt Snowball?

Karisa came across the Debt Snowball method when she was researching ways to pay down debt, and it was clear why it’s such a popular option. She says,

“Debt Snowball is a plan that’s designed to help you tackle debt fast by creating momentum. You start by figuring out how much extra money you have available to put towards your debt each month, and while you pay the minimums on all your other debts, you use your snowball payment—which should be larger than the minimum amount—to pay down the debt with the smallest balance first.”

By paying off the smallest debt first, you’ll get a quicker win — and motivation to keep on going! As you pay off debt, your snowball will get bigger, giving you more debt payoff power.

In order for the Debt Snowball method to work, you need a budget that prioritizes paying off debt — aka, having the biggest snowball you possibly can, and we’ll get more into that in the next lesson. But before you can make a budget that works, you gotta take aim at your debts by creating Accounts in Goodbudget.

But first…

We think using an app like Goodbudget is a great way to create and keep a budget. If you’re not using it yet, create your Goodbudget now! Then, proceed to the steps below that match where you are on your journey.

Homework

Accounts in Goodbudget: What they are and how to add them

What are Accounts in Goodbudget?

Goodbudget is a budget tracker that helps you plan and keep a budget using Envelopes. Goodbudget also allows you to track your real-life accounts virtually with Accounts. While Envelopes keep track of how you want to spend or save your money, Accounts keep track of where that money actually is.

In addition to tracking things like a Checking Account, you’ll also create Debt Accounts, which are a special kind of Account that’s designed to help you track your debt payoff progress. You’ll be able to track as many Debt Accounts (and Debt Envelopes) as you need.

By using Debt Accounts in Goodbudget, you’ll be able to see exactly how much you pay each month towards debt. You’ll be able to start shaping your “snowball” payment in the next assignment by creating your budget (aka your budget Envelopes).

Add your Accounts

If you already use Goodbudget…

If you already use Goodbudget, you probably already have all of the Checking, Savings, and Cash Accounts you plan to track. But if you’re not tracking any of the debts you listed from the last assignment as Debt Accounts, be sure to add them now.

NOTE: If you don’t already have an individual Envelope for each of your debt’s monthly payments, you’ll connect your Debt Account to a [NEW] Debt Envelope. Otherwise, you’ll link your Debt Account to the Envelope you currently pay your debt out of.

If you just signed up with Goodbudget…

If you’ve just signed up, you’ll need to create all the regular Accounts and Debt Accounts you plan to track in Goodbudget now.

- Add Checking, Saving and/or Cash Accounts: Head to the Add/Edit Accounts page to begin adding any Checking, Savings or Cash Account(s) you’d like to track. You can also add any credit cards that represent debts you still use regularly and are not working to pay off. You’ll set all of your Account balances to match what you have in your real-life accounts right now.

- Add Debt Accounts using your list of debt: Here’s how you can create a Debt Account.

- NOTE: Since you don’t have any Envelopes yet, be sure to connect your Debt Account to the [NEW] Debt Envelope.

That’s it for this assignment! Even though it might be overwhelming, we hope seeing your list of debts in your budget helps motivate you towards paying everything off.

In the next assignment, you’ll create a budget that will operate as your guide throughout the rest of your debt payoff journey.

Discussion

Now that you’ve got a list of your debts in one place, it’s easier to see the total amount of debt you have to tackle. Karisa said seeing the full sum of her debt felt overwhelming, but that making a plan actually helped calm and motivate her.

We want to know how you feel seeing all of your debts together? Overwhelmed? Excited? Something else?

5 thoughts on “Line Up Your Targets and Take Aim”

It feels both overwhelming and somewhat satisfying. It’s overwhelming because it’s such a big number, but it’s satisfying because at least it’s smaller than when we started!

I feel glad that I did it and that I am on the road to paying off my debt, but I’m also feeling impatient because I don’t know how quickly my snowball will really start making a visible difference!

Thanks for sharing, Mary! Even small changes make a big difference down the road. Keep it up 😀

I was doing really well on paying down my debt until I had to add $10,000 for home and car repairs last year. I wanted to cry.. and did! I felt like I took one step forward and two steps back! Looking at that total amount of debt made me more determined to stop and think before I spend, push back any planned projects and get myself ready to tackle this monster!

it is overwhelming to me