This spring, I came across an opportunity to help a friend. This friend of mine would be living in the slums of Manila and working with women exiting prostitution, and I hoped to help her get there. There are many cool short and long term projects like this that I would love to support, but my question was “How much can I afford to give?” I wanted to give more money away, but I never knew how far my money could go.

Shortfalls of Account Balance Budgeting

As an inexperienced budgeter, I had trouble finding a balance between excessive spending and fearful thriftiness. I used to look at my checking account balance when making financial decisions. I’d see my balance, try to estimate a needed cushion plus any known future expenses, and then be willing to spend the difference. This elementary form of budgeting kept me from going in the red, but it didn’t give me a picture of where my money was going. It also kept me from making more bold and generous choices with my money.

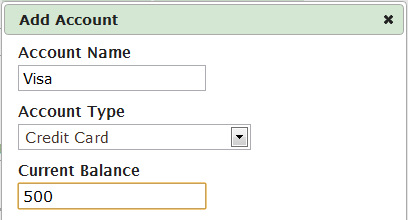

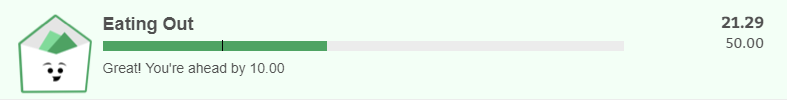

Creating a Budget with Goodbudget

In order to determine how much I could afford to give, I decided to create a budget with Goodbudget. With each step, I became closer to my goal—

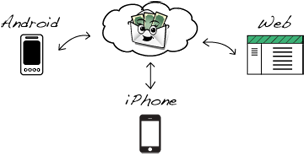

Did you know you can sync your EEBA household across multiple mobile devices and the web?

Did you know you can sync your EEBA household across multiple mobile devices and the web?