Have you ever felt like the more you make, the less you have? You know you’re bringing more money home each month, but somehow it feels like you have less to spend than ever. That’s what it feels like when you don’t have control over your spending, and that’s when it’s more important than ever to have a budget.

I experienced this a few months ago when I got a raise at work. Perfect, I thought, since I was already living off my current income the raise would all be extra. I could set it aside towards a goal in Goodbudget, add it to my Savings, or whatever I needed. Unsure of how I wanted to use the extra money, I decided to just let it gather in my Available money. As the months passed, however, I was surprised to find that my Available balance wasn’t increasing as I thought it would, but was in fact decreasing. What was going on?

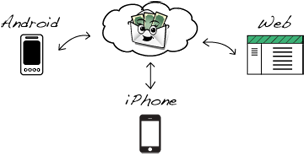

Did you know you can sync your EEBA household across multiple mobile devices and the web?

Did you know you can sync your EEBA household across multiple mobile devices and the web?