With Fall fast approaching, students everywhere are leaving their nests to set off to college. With more and more students taking loans to finance their education, however, learning how to budget and live off student loans is more important than ever.

The hardest part about budgeting with student loans is that you get it all at once. With a pile of cash in the bank, it’s just too easy to look at your bank balance and think you have more to spend than you really do, leaving yourself short in the months ahead. To make sure you don’t overspend, treat your student loan like an income you receive over time. If you’re borrowing 6,000 to pay for the next four months, treat it as a monthly budget of 1,500 (6,000 / 4 = 1,500) that you’ll need to maintain each month. That way, you can be sure you’ll have enough to cover your needs till your next loan disbursement.

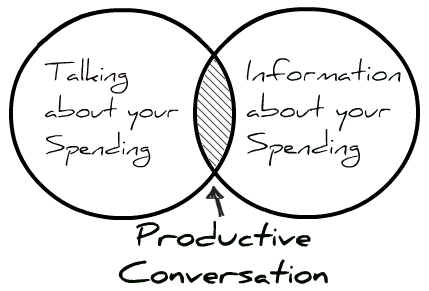

Anyone who’s tried, knows. Sitting down to talk about money can be stressful. Whether it’s a spouse, a child, a dependent parent, or even a roommate, our lives –and our money– are interwoven with those around us, and with that comes conflict. We enter conversations about money with the best of intentions, but often leave frustrated or even resentful.

Anyone who’s tried, knows. Sitting down to talk about money can be stressful. Whether it’s a spouse, a child, a dependent parent, or even a roommate, our lives –and our money– are interwoven with those around us, and with that comes conflict. We enter conversations about money with the best of intentions, but often leave frustrated or even resentful.