EEBA is now Goodbudget! You can find the most up-to-date information about using Goodbudget on our Help Center.

Angela Colley is a financial writer for Money Crashers Personal Finance, an online resource with tips for budgeting, saving for long-term goals, and planning for early retirement.

For years, I kept track of my financial budget on a piece of paper in my desk drawer. It was an okay system, but it didn’t allow me to track my financial goals. I just didn’t have the time to compare my spending with my budget each month.

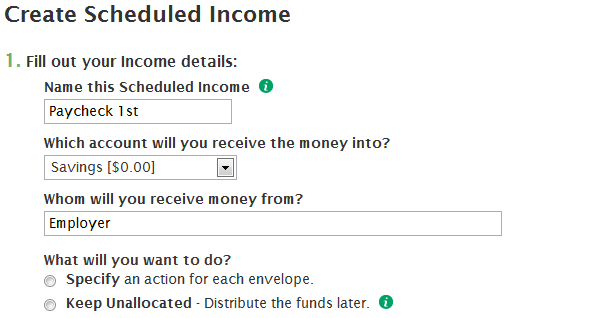

Then I got a smartphone and discovered the Easy Envelope Budget Aid (EEBA) app. Now I stay on top of my finances, stay within budget, and always have enough money for what I need. It took me a while to work out a budgeting system using the EEBA app, but now I have great system, and you can too.

Here are some tips you can use to get the most out of the EEBA app:

1. Create Plenty of Envelopes

A well-organized tracking system makes it easier to make a budget, and to know exactly where your money goes. The EEBA app utilizes “Envelopes” as a method of creating budget categories. When I first started budgeting, I used one Envelope for my house, one for necessities, and one for extras. Now, I have 10 Envelopes to cover everything I buy through this Envelope Budgeting System.

The EEBA app helped me to understand that I need to spend less money on extras and dining out. You can quickly add Envelopes using the EEBA app to help you stay on budget. Use all of the Envelopes you think you might need when you start using the Easy Envelope Budget Aid, and don’t hesitate to add more as you need them.

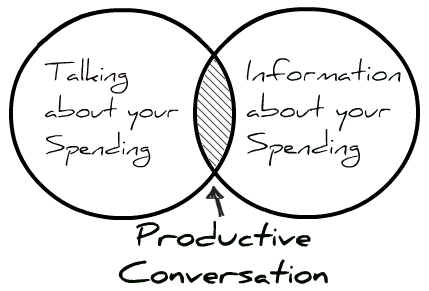

Anyone who’s tried, knows. Sitting down to talk about money can be stressful. Whether it’s a spouse, a child, a dependent parent, or even a roommate, our lives –and our money– are interwoven with those around us, and with that comes conflict. We enter conversations about money with the best of intentions, but often leave frustrated or even resentful.

Anyone who’s tried, knows. Sitting down to talk about money can be stressful. Whether it’s a spouse, a child, a dependent parent, or even a roommate, our lives –and our money– are interwoven with those around us, and with that comes conflict. We enter conversations about money with the best of intentions, but often leave frustrated or even resentful.