Update

EEBA is now Goodbudget! Goodbudget has all the great features of EEBA (and more!) in a new and updated interface. Check out our updated article on this topic, and check out the Goodbudget Help Center for the most recent help content.

If you get paid every four weeks, you’ll receive 13 paychecks over the course of the year. The best way to budget for that is with a monthly budgeting period based off one of your paychecks. This will help you keep a consistent budget month to month and will give you a bonus paycheck at the end of the year that you can use to pay down debt, build up your savings, or simply enjoy!

Budget off one paycheck

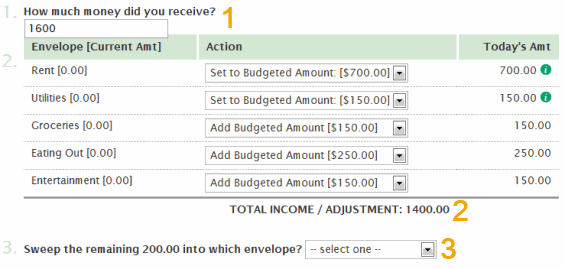

Start by creating a budget based off one of your regular paychecks. To do this, head to the “Edit Budget” page in EEBA. Here you can create your Envelopes with their budget amounts. As you create your budget, make sure that your total “Budgeted” amount is less than your paycheck.

Crafting a budget that fits into a single paycheck may mean making some tough choices, but stick with it! Resist the temptation to include a portion of your next paycheck into your budget, and you’ll be rewarded with greater peace of mind and a budget that’s flexible enough to deal with the surprises that always come up each month.

Not sure how to start? Check out our blog post on How to Make a Budget.

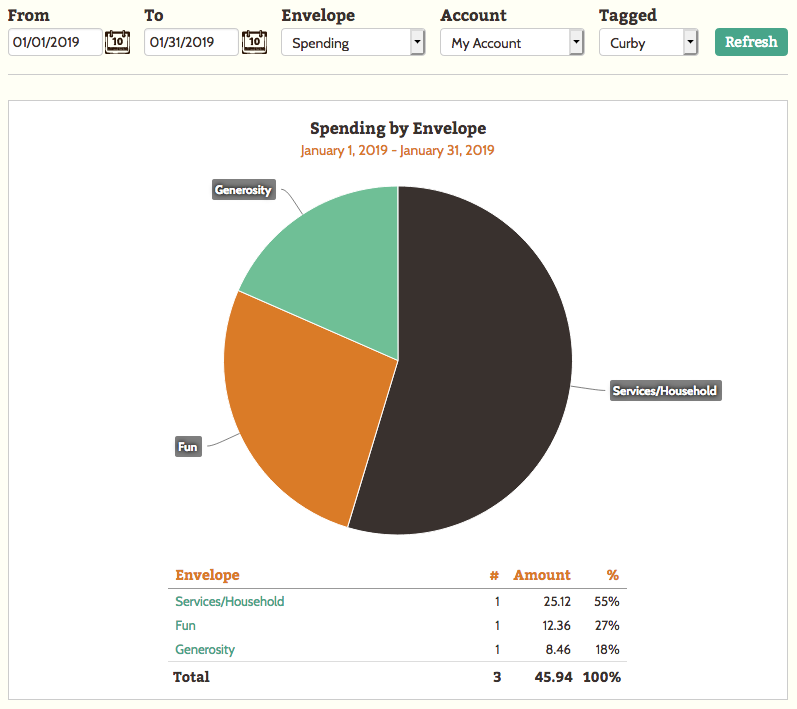

I recently got a puppy named Curby. She’s a fearless little Chihuahua-mix that enjoys napping in laps, chewing on shoelaces, and sunbathing on the deck. At first I wasn’t sure how to include her in my regular budget, so I decided to add her expenses in my existing Envelopes and

I recently got a puppy named Curby. She’s a fearless little Chihuahua-mix that enjoys napping in laps, chewing on shoelaces, and sunbathing on the deck. At first I wasn’t sure how to include her in my regular budget, so I decided to add her expenses in my existing Envelopes and

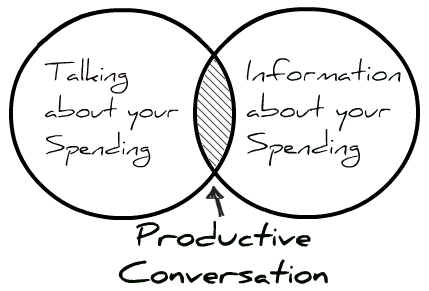

Anyone who’s tried, knows. Sitting down to talk about money can be stressful. Whether it’s a spouse, a child, a dependent parent, or even a roommate, our lives –and our money– are interwoven with those around us, and with that comes conflict. We enter conversations about money with the best of intentions, but often leave frustrated or even resentful.

Anyone who’s tried, knows. Sitting down to talk about money can be stressful. Whether it’s a spouse, a child, a dependent parent, or even a roommate, our lives –and our money– are interwoven with those around us, and with that comes conflict. We enter conversations about money with the best of intentions, but often leave frustrated or even resentful.